Value Added Tax (VAT) verification is a tedious but crucial step for businesses registered in the UAE. The Federal Tax Authority has increased its enforcement and imposes penalties for incorrect VAT practices. Verifying a VAT number (Tax Registration Number) prevents compliance issues, which in turn protects your business from penalties and denied VAT refunds.

This matters more in 2025 with the updates in EmaraTax digital systems. The Federal Tax Authority (FTA) reports that it is expanding its use of new digital technologies and intensifying compliance monitoring. In 2024 alone, the FTA conducted 93,000 field inspection visits — a 135% increase from the previous year. As they continue to intensify audits and automated checks, businesses are seen relying more on digital verification tools to avoid mistakes.

This practical, step-by-step free guide is for business owners, finance teams and freelancers working with UAE clients. Anyone issuing or receiving VAT invoices in the UAE needs to be aware of how to verify a valid 15-digit TRN through the official FTA portal, and common issues and how to fix them.

Introduction: What is the VAT Number in the UAE?

The VAT Number or otherwise known as the Tax Registration Number (TRN) is the identification number given to a business upon completion and approval of their VAT registration. The VAT number is a unique 15-digit identifier issued by Federal Tax Authority, and it is a business requirement to have it listed in your invoice for all your transactions. The VAT Number is only needed when you cross a certain threshold in supplies, as VAT tracks the value added at each stage of the supply chain.

In that note, the VAT number is considered a mandatory legal requirement for businesses exceeding the AED 375,000 taxable supplies threshold for the rolling previous 12 months. The company’s VAT number allows businesses and customers to confirm that a company is legally recognized under the country’s tax system.

Note that the VAT Tax Registration Number in the UAE is different from the Corporate Tax Tax Registration Number (otherwise known as CT TRN). The Corporate Tax TRN is used for Corporate Tax returns and CT-related dealings with the FTA.

The structure of the TRN is as follows:

- The first 3 digits: Represent the Federal Tax Authority (FTA) and often list the numbers 100.

- The middle 9 digits: Unique identifier specific to the business or individual registrant.

- The final 3 digits: Called “the check digits” used for verification that the VAT number is inputted correctly

In short – upon submission and approval of the VAT registration form, having the VAT number will serve as proof that this is a VAT registered business in the UAE.

Why You Need to Check VAT Numbers in UAE: Compliance and Fraud Prevention

Verifying the VAT registered number in the UAE is equally as important for both businesses and customers. There are certain benefits in verifying that legal entities carry a valid VAT number. Here are some of the reasons why you need to check first and always have your VAT number ready before transacting in the UAE:

- Businesses must ensure that suppliers are legally VAT-registered before claiming Input VAT Credit. Verifying their TRN upfront ensures input VAT claims are legitimate and compliant with VAT regulations. Verifying your supplier’s VAT number is essential to prevent incorrect invoicing since some businesses issue tax invoices without being registered.

- VAT registered businesses can help a taxable person claim their VAT refunds easily, which leads to a better relationships and business dealings overall (i.e. to recover input VAT, the supplier must hold a valid TRN).

- Always have your VAT registration number ready to protect your company from FTA penalties. Additionally, you can avoid unnecessary legal risks by ensuring that your VAT number is properly posted and ready for compliance in accordance to Federal Tax Authority (FTA)’s rules and regulations. The TRN will be required during audits, especially when FTA requests proof of supplier registration.

In summary, doing your part verifying TRNs helps maintain accurate tax reporting, further reducing legal headaches and complications. For one, the paper trail helps avoid denial of Input VAT Credit for invoices issued by invalid or unregistered suppliers. Overall, having a valid VAT number strengthens business credibility and avoids disputes with clients or auditors.

How to Check VAT Number in UAE: Step-by-Step Guide

The UAE’s equivalent of a VAT information exchange system is overseen by the Federal Tax Authority (FTA) portal. In other words, this portal is considered as the primary system for managing and exchanging VAT information within the UAE.

Important note:

TRN verification is a public tool and doesn’t require a login. Anyone who is claiming to verify on your behalf for a fee is most likely a scam.

To check digits of the VAT number, here are the steps:

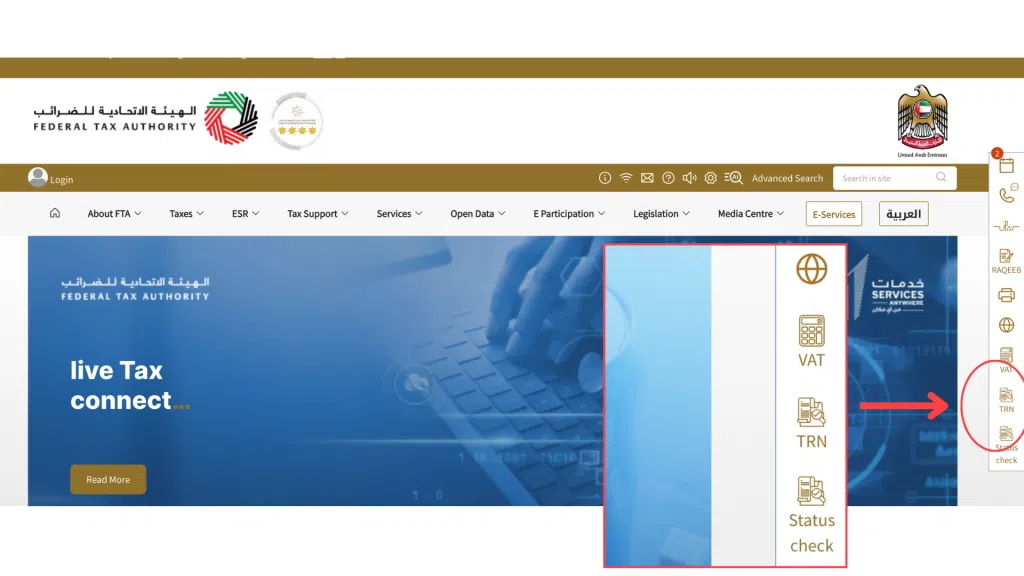

Step 1: Visit the official UAE FTA portal: https://tax.gov.ae/en/default.aspx and on the right panel of the website, click the icon that says “TRN” under the “VAT” icon

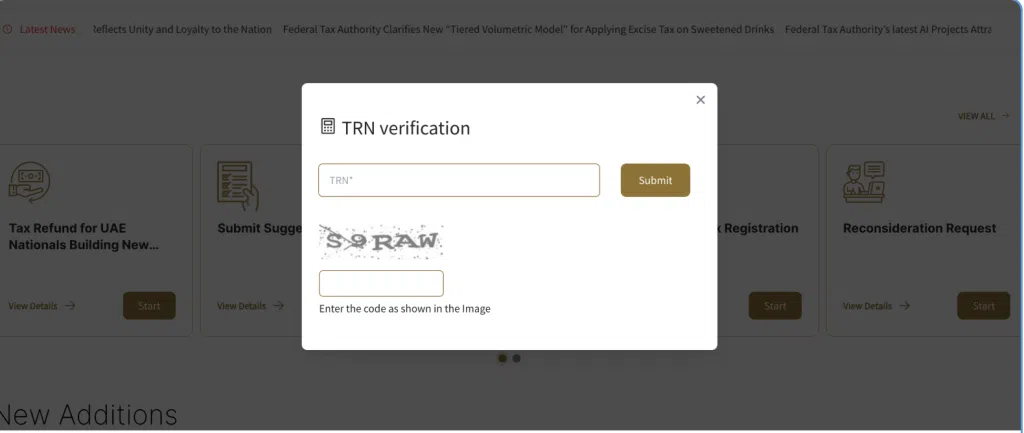

Step 2: A window will open that includes the TRN verification field. Simply input the 15-digit vat number in the search field and complete the captcha verification to continue.

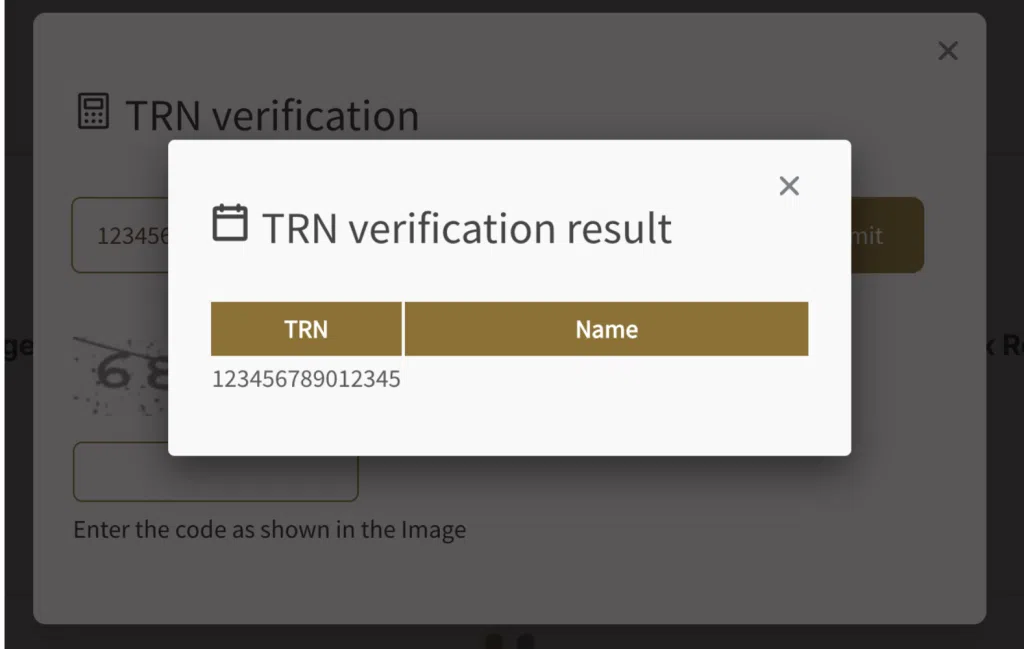

Step 3: After you click submit, the portal confirms whether the TRN is active by seeing the registered businesses’ name in the box together with the number. A wrong or unregistered number in the UAE will list as blank under the Name column

Wrong VAT number will reflect a blank business name.

You can use the UAE’s EmaraTax portal to administer taxes in the UAE and fulfill your VAT obligations. EmaraTax requires you to log in before you can use. Since this is required for VAT registration, once you have obtained the VAT registration certificate, you most likely would already have a working account that you can use for the duration of your business.

VAT Registration Requirements in UAE: Mandatory vs Voluntary Registration

Value added tax is implemented by the government effective 2018, and since then, they have revised policies depending on the context and needs of its businesses. While certain details have changed over time, knowing the rules for mandatory and voluntary registration is a good first step to understanding UAE tax laws.

Voluntary Registration: Legally, the voluntary threshold is based on taxable supplies and imports, or taxable expenses. Businesses who exceed the voluntary registration threshold of AED 187,500 in annual taxable supplies and imports or expenses may register voluntarily in order to claim vat refunds early. Additionally, if the business is importing, registering enables owners to use the reverse charge mechanism (RCM), which is cash-neutral vs paying cash VAT at the borders.

Similarly, a startup with big taxable expenses and low revenue can register voluntarily to claim benefits of voluntary registration.

Mandatory Registration: Businesses exceeding the threshold of AED 375,000 in taxable supplies within a span of 12 months must settle a registration date within 30 days before penalties can apply. Reversely, owners foreseeing that they will pass this threshold in the next few months can proactively apply in order to remain compliant.

VAT registration applies to mainland companies, free zone entities, e-commerce sellers, freelancers, and service providers conducting business operations within UAE; although some goods or services may qualify for either a 0% VAT rate or full exemption, provided they meet the required conditions.

While VAT can be voluntary, it is all businesses’ responsibility to ensure that all business income and expenses must be properly kept accurate and up-to-date in their financial records so they can determine when VAT registration threshold is passed and becomes mandatory.

How to register for VAT number in the UAE

o register for a VAT number, you need to sign up for an EmaraTax account through the FTA’s website and fill up the registration form with all the required documents properly submitted. You will be notified of your registration status together with your VAT registration number upon approval.

Please note that there is no registration fee needed to access the platform, but it does help to have a professional navigate the complex UAE tax regulations with you. This can entail certain service costs.

According to the Federal Tax Authority, you need to prepare and collect all the required documents, ensure verified information is accurate, and then submit the following. Keep in mind that the requirements vary depending on the type of legal entity.

- Certificate of Incorporation, Memorandum of Association, or Partnership Agreement (if applicable).

- Commercial registration certificate, or any official document issued by the licensing authority

- A valid trade license, along with branch licenses (if any).

- Emirates ID and passport of owners, managers and authorized signatories.

- Power of attorney document for the authorized signatory, required if the manager’s name is not mentioned in the Memorandum of Association, or when adding other individuals as authorized signatories.

- Official declaration letter stating the total taxable supplies and monthly sales from the date of establishment until the date of application, stamped and signed by the authorized signatory.

- Supporting documents, such as invoices, local purchase orders, contracts, ownership deeds, completion certificates, and lease agreements, as applicable to the type of application.

- For supplies: upload at least three sample invoices that demonstrate your taxable supplies in the UAE.

- Expected revenues supported by valid documents, such as purchase orders or contracts, stamped and signed by both parties.

- Bank letter detailing the bank account information (optional):

- For legal entities: the account must be in the company’s name.

- For individuals: a personal or sole establishment account can be used.

- Customs information (if available).

- Registration documents and supporting evidence for clubs, charities, or associations (Applicable when selecting “Legal Person – Club, Charity, or Association”).

- Copy of the Decree (Applicable when selecting “Legal Person – Federal Government Entity in the UAE” or “Legal Person – Emirate-level Government Entity in the UAE”).

Accepted file formats: PDF and DOC. Maximum file size per document should be 15 MB or else you won’t be able to upload it in the EmaraTax portal.

By coming prepared, you reduce the risk of getting your application declined even before you even open your VAT registration form; often, businesses get declined due to insufficient documents or missing information. You can also get fined if the authorities find wrong information that hasn’t been amended proactively.

Common VAT Number Issues and Solutions

UAE tax regulations may seem strict, but it helps to be aware of typical issues and remedies available should you encounter this with the Federal Tax Authority (FTA). You can easily avoid some of these issues by being mindful:

- Invalid TRN input: Usually caused by mistyped digits or missing characters. This can more severely apply when you pay VAT, in which case you need to be mindful that the 15-digit number is typed correctly.

- TRN not found: supplier may not be registered or registration is suspended. This can potentially invalidate VAT transactions and FTA may reject your claim vat refunds. Engaging with unregistered suppliers who issue “VAT invoices” can raise red flags, lead to denial of input VAT and significantly increase the risk of an FTA audit.

- System downtime: Temporary EmaraTax maintenance or server issues can happen

- Language mismatch: English/Arabic trade name variations.

Some easy solution fixes if you encounter any of these issues:

- Re-enter TRN carefully

- Confirm TRN from supplier invoice

- Retry after system downtime

- Contact FTA support (landline: 800 82923) or email them via info@tax.gov.ae. You can find details on working hours here

How skrooge.ai Simplifies VAT Management

Skrooge combines advanced AI automation with the oversight of seasoned finance and accounting specialists. It acts like an AI CFO handling sorting, reconciliation, filing, and reminders flawlessly and instantly. Our technology can flag missing TRN, mismatched names, invalid formats, and track taxable transactions without the tedious manual verification.

Skrooge can manage massive volumes of invoices for any type of a client in minutes and reduce risk of penalties.

We are not software reliant to get the job done. Our team of human experts can devote their time to strategic tasks like structuring tailored charts of accounts and solving complex tax challenges for our clients. Because of our AI-powered accounting and VAT automation software, you can maximize our professional accountants’ expertise and services for complex compliance issues, and reduce errors to keep you audit-ready with accurate, real-time VAT records.

Best Practices for VAT Compliance & Tax Management in UAE

To ensure smooth business operations, it helps to stay compliant and be proactive in managing tax compliance:

- Upkeep bookkeeping – even if your business does not meet the required threshold yet, it helps to continuously track, update and make the necessary revisions to your financial statements in real time. For VAT registered business, it is paramount that you are organized with your invoices, receipts and contracts so you are surely tracking your charged VAT and VAT paid.

- Conduct regular verification and flag for non compliance. Make it a habit to conduct regular TRN verification for suppliers and ensure invoices follow official FTA format with its mandatory fields.

NOTE:

You can read more and download sample invoice templates here: Proper tax invoice format UAE

- Utilize professional support available for legal compliance. Make full use of professional support to stay compliant with UAE VAT laws by filing your VAT returns on time (whether monthly or quarterly.)Additionally, getting consultants earlier in your business life can help you with monitoring your turnover to ensure you register as soon as you cross the required threshold. Using tax consultants or automated service providers like skrooge.ai can help streamline the process and keep your records accurate, making it easier to stay audit-ready with clean and complete documentation for the FTA.

Frequently Asked Questions (FAQs)

Simply visit the official UAE online portal: https://tax.gov.ae/en/default.aspx and on the right side of the website, click the icon that says “TRN” under the “VAT” icon. Type the details, hit submit, and you should see the business carrying the same VAT number.

VAT verification, while tedious, becomes necessary once you determine someone is using an invalid VAT number. Using an invalid VAT number can have serious consequences for your business. The Federal Tax Authority (FTA) may reject claims for input tax credit if the supplier’s registration number is not genuine or properly documented. Additionally, such non-compliance can trigger administrative penalties and increase your risk of a full tax audit.

You can find it in valid VAT invoices, their TRN certificate (sometimes asked as part of due diligence), or by simply asking the supplier.

For both a full tax invoice and simplified tax invoice, the supplier name must be present together with their registered business address and VAT registration number. Failure to comply or supplying incorrect information can amount to a AED 2,500 fine for each detected case.

Typically, VAT registration process take 2 to 3 working weeks to complete. You can read more about the VAT registration process in the UAE in our article here.

Under UAE tax laws, VAT number will refer to the Tax Registration Number given for VAT registration, which is not to be confused with the Corporate Tax TRN (or CT TRN) used for corporate tax registration. Both are 15-digit unique identification numbers, but they refer to different tax registrations and not interchangeable. CT TRN cannot be used for VAT purposes and vice versa.

The VAT Number must appear on tax invoices, VAT returns and all documents related to VAT tax compliance. The Corporate Tax TRN is used for filing corporate tax returns and Federal Tax Authority CT portal access.

Yes, there is no need to log in in order to verify a VAT number in FTA portal.

Make sure to recheck that you input the digits correctly. If it still fails, contact the supplier to ensure that the number is accurate.

In some cases, you can wait a bit longer and input again later, since it could be that the system is currently down. Alternatively, you can contact relevant authorities or FTA support to report problems.

VAT registration applies to mainland companies, free zone entities, e-commerce sellers, freelancers, and service providers conducting business operations within UAE, although some goods or services may qualify for either a 0% VAT rate or full exemption, provided they meet the required conditions. There are options for a voluntary and mandatory registration, depending on where your business is at that certain period.

Skrooge combines powerful AI with expert accountants to act like your always-on CFO, sorting, reconciling, and filing documents quickly and accurately. It can process thousands of invoices across multiple clients at a speed no human team can match, ensuring seamless tax-invoice and VAT compliance. This frees our specialists to focus on strategic work like building tailored charts of accounts and delivering high-value tax advisory services.

Our primary goal is to help you navigate the UAE tax laws effectively. To get started, simply book a consultation call. Through our fast 15-minute VAT consultation process, simply share with us your recent VAT filings and a sample of invoices to get a clear view of next steps.

Once all is in order and confirmed, onboarding will be done with professional accountants who will conduct further diagnosis of your business.

Thank you!

We've received your request and will get back to you shortly.