What’s the difference between an average and a great accountant?

An average accountant will simply categorize transactions into the chart of accounts you give them.

A great accountant will first understand your business and how you look at it – your model, unit economics, decision-making – and then design the chart of accounts around that.

He might even suggest new ways of slicing your business you haven’t thought about yet.

The whole point:

- Your chart of accounts is not a compliance formality.

- It’s the data model of your business.

Why the chart of accounts actually matters?

If the chart of accounts is done poorly, you don’t just get useless or ugly reports.

You get a distorted picture of reality.

- Wrong unit economics or ROI = Wrong idea of what’s working vs. what’s burning cash

- That distortion leads to bad decisions – wrong pricing, wrong hires, wrong bets.

It’s like flying a plane with a miscalibrated altimeter: the numbers are there, but they’re lying to you.

What a good chart of accounts should do?

Be as MECE as possible

Your categories should be:

- Mutually Exclusive – transactions clearly belong in one bucket, not several

- Collectively Exhaustive – they cover ~90% of what you actually do, without huge “other” buckets

Have the right depth

- Too shallow → one giant line (“Marketing”, “Other expenses”) that tells you nothing.

- Too deep → you’re staring at individual transactions instead of patterns.

Rule of thumb:

- It’s okay to go slightly more detailed than you “need”, because you can always group up later.

- It’s hard to get detail back if you never separated it in the first place.

Break down Revenue & COGS by what you actually sell

Your main products / services / items should have:

- Separate Revenue lines

- Matching COGS lines

So you can see true margins per stream, not just a blended number.

Break down costs by what drives them

At minimum, separate:

- COGS – costs that scale with clients / units sold / revenue

e.g. payment processing, delivery, variable freelancer work, direct support per client - Sales & Marketing (S&M) – costs that scale with growth efforts

e.g. performance marketing, sales commissions, outbound tools, lead gen, events - G&A / Platform & Tech – costs that are fixed or scale slowly

e.g. founders’ salaries, core team, rent, infra, core software stack

From there you can add more slices that matter for unit economics and ROI, for example:

- By marketing channel (Google, Meta, referrals, etc.)

- By type (payroll vs software vs contractors)

- By team / department

At Skrooge, we don’t just “bookkeep.” We sit with you and design the chart of accounts together, so every line in your P&L actually reflects how your business works.

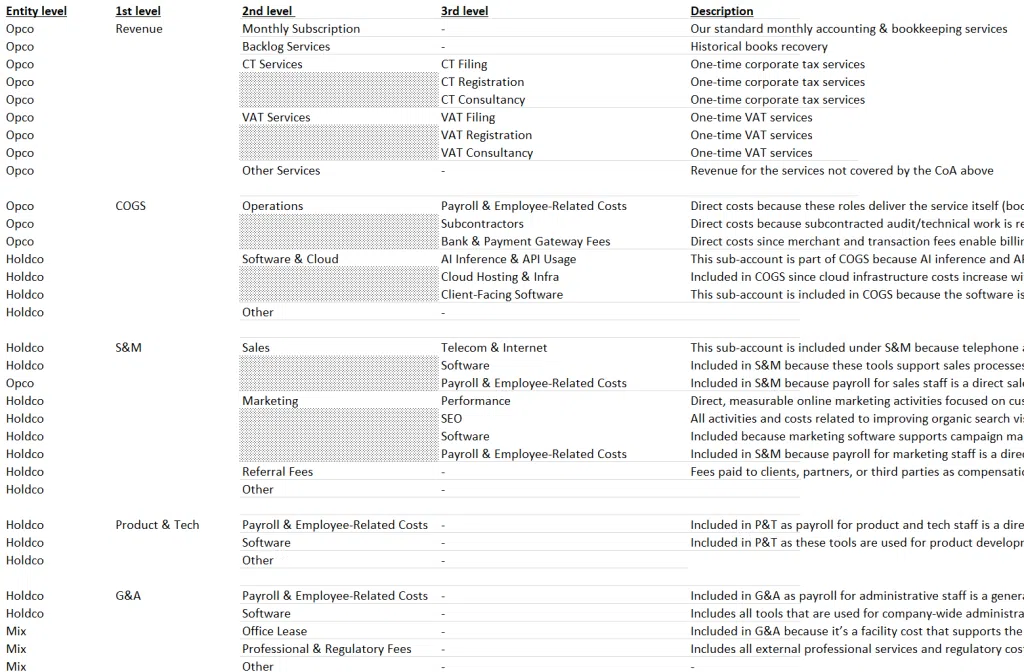

Please find below as an example the simple chart of accounts we came up for our 2 companies – we tried to follow the principles above that I mentioned.

Thank you!

We've received your request and will get back to you shortly.