What is the goAML System?

The United Nations Office on Drugs and Crime (UNODC) developed the goAML system for use by national financial intelligence units. This financial reporting framework is meant to streamline filing suspicious transaction reports and ultimately combat money laundering and terrorism financing.

Since goAML was introduced in the UAE, registration to this system has become compulsory for AML compliance, at least for Designated Non-Financial Businesses and Professions (DNFBPs).

Who Should Register for goAML in UAE?

In the UAE, all Designated Non-Financial Businesses and Professions (DNFBPs) must mandatorily register on goAML.

DNFBPs generally include most real estate firms, auditing and accounting firms, precious metals and stones dealers, trusts, and company service providers.

Here’s a more detailed explanation of when businesses and professionals qualify as DNFBPs and thus must register on goAML.

Type of firm/professional services |

Activities that trigger the need to register on goAML |

|---|---|

Real estate firms |

Completing real estate transactions (purchase/sale) on behalf of clients |

Dealers of precious metals and stones |

Execution of single or multiple connected transactions whose value exceeds AED 55,000 |

Independent legal practitioners and accountants |

Planning, performing, or executing the following kinds of financial transactions for clients:

|

Trusts and company service providers |

Performing the following services for clients:

|

Note

While the above table is a comprehensive list of businesses and professional service providers who must register on goAML, the UAE government may choose to expand or contract said list at any given moment. So, always check with your legal counsel or contact Skrooge to understand your goAML registration triggers.

Documents Required for goAML registration

The three key goAML registration documents are as follows:

1. Identification

You will need to submit copies of your passport, resident visa, and Emirates ID as identity proof.

2. Authorization letter

goAML registration can only be completed by parties authorized to act on the company’s behalf. To prove that you have been authorized by your business, you will need an authorization letter.

3. Trade license

If your business is a reporting entity required to register on goAML (e.g., a DNFBP), you will typically need to upload a copy of your valid UAE trade license. This allows the FIU/supervisory authority to confirm your legal identity, licensed activities, and issuing authority.

Tip

While this is not a document, it is recommended to also have the Google Authenticator app installed on your phone during goAML registration, since you will receive the password for the goAML portal through this app.

goAML Registration Process

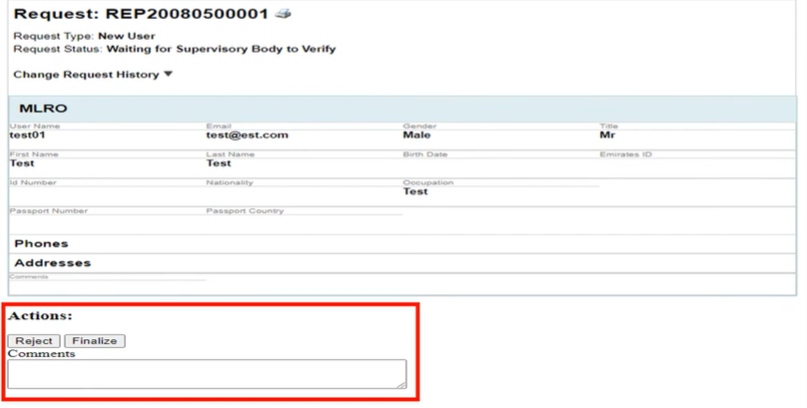

The goAML registration process is twofold. First, you must complete your SACM registration to receive the credentials for accessing the goAML portal. Then, you can complete your goAML registration on the UAE’s Financial Intelligence Unit (FIU) website.

Here’s a detailed overview of the goAML registration process:

Stage 1: SACM Registration

To complete the SACM registration, you will need to prepare scanned copies of your Emirates ID, your company’s trade license or incorporation certificate, and an authorization letter (to act on the company’s behalf specifically for goAML registration or to act as the Money Laundering Reporting Officer (MLRO)).

Step 1: Compile all documents required

Once you have compiled these documents, click here to access the FIU’s website. Then, click on the ‘Registration’ button in the top right corner.

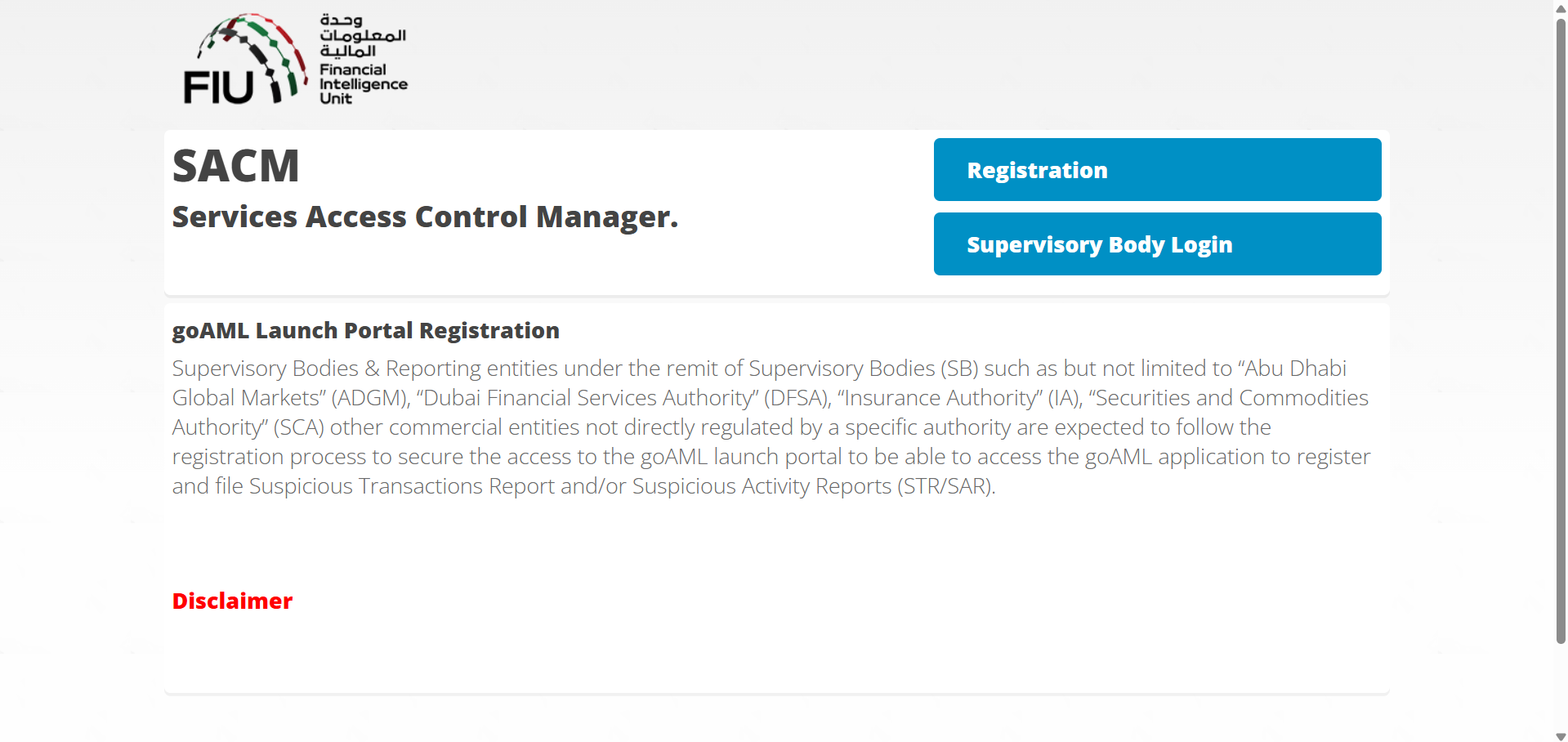

Step 2: Fill registration form

Once you click on the registration button, you can start filling out the following form. You must provide details, such as the entity ID number and user details. Please ensure that the submitted email ID and mobile number are operational and can receive email and SMS OTPs and notifications. Do not forget to attach the earlier-mentioned documents. Before clicking submit, select the checkbox confirming that you have read and accepted the goAML portal terms and conditions.

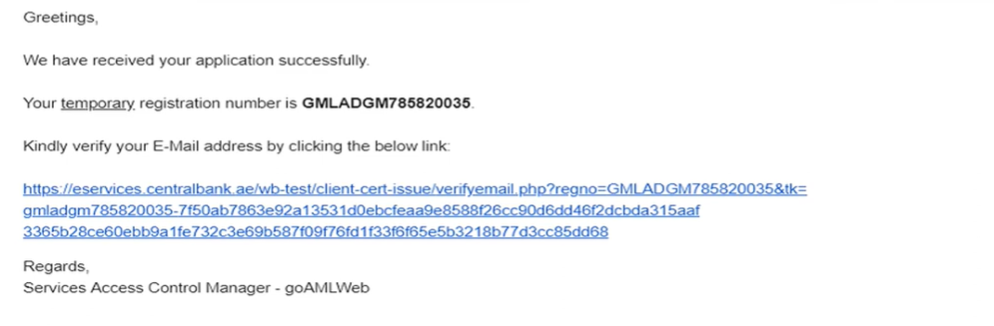

Step 3: Verify email ID

Once you click the ‘Submit’ button, you will receive a temporary registration number via the email ID you submitted. The same email will also contain a link to verify your email ID. If you do not verify your email ID, you cannot proceed with the registration. Check your spam or junk folders if you cannot find the email verification link. If you still cannot find the email, try whitelisting ‘webmaster@eservices.centralbank.ae’ and then, send a request to resend the verification email to ‘goaml@cbuae.gov.ae’.

Step 4: Supervisory body review

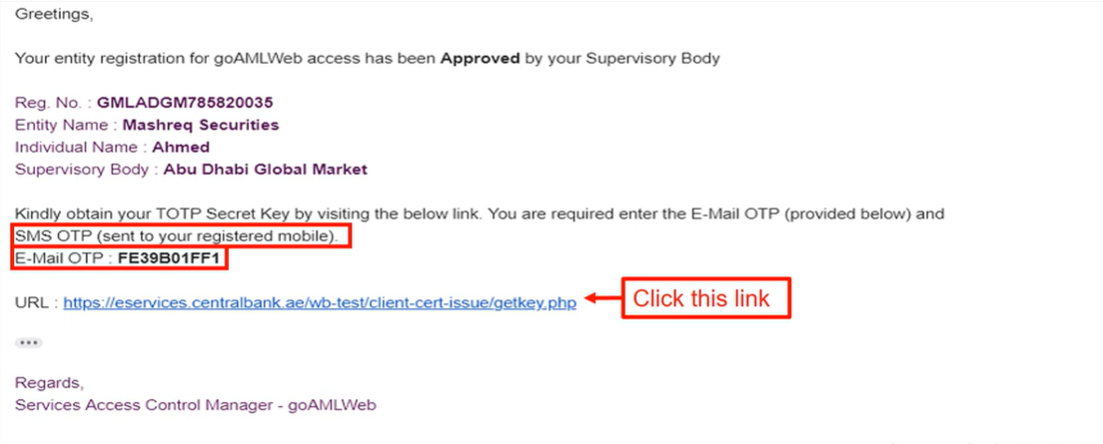

Once you have verified your email ID, the supervisory body will scrutinize your registration form and the attached documents. If the supervisory body is satisfied, you will receive OTPs via SMS and email.

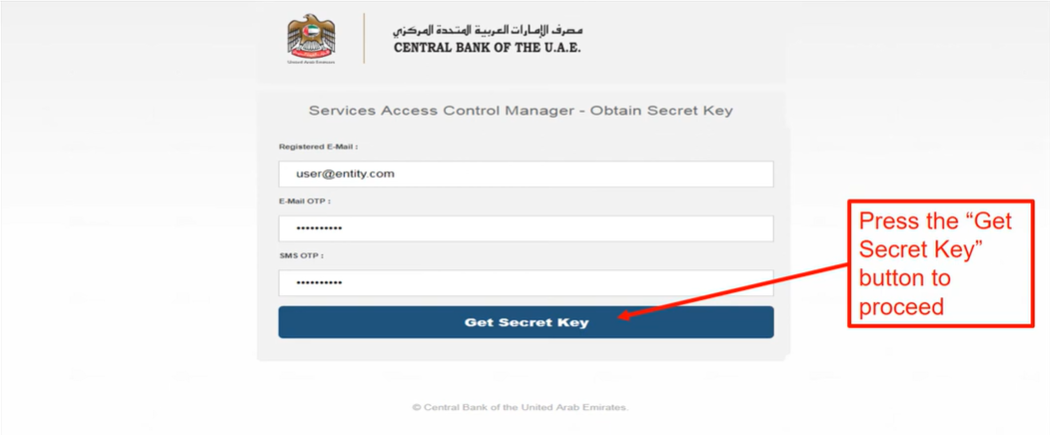

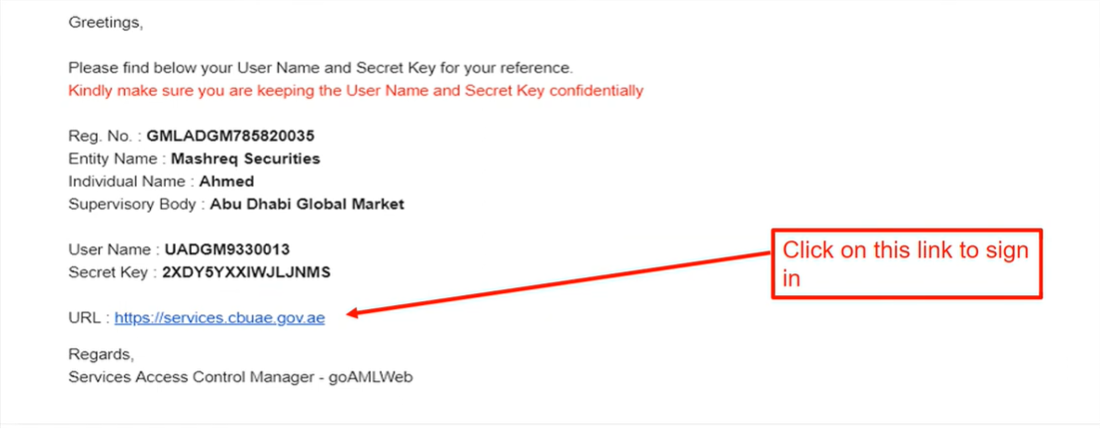

Step 5: Obtain SACM secret key

Click on the link shared in the email. Then, in the window that opens upon clicking the link, enter your registered email ID, SMS OTP and email OTP and click on ‘Get Secret Key’.

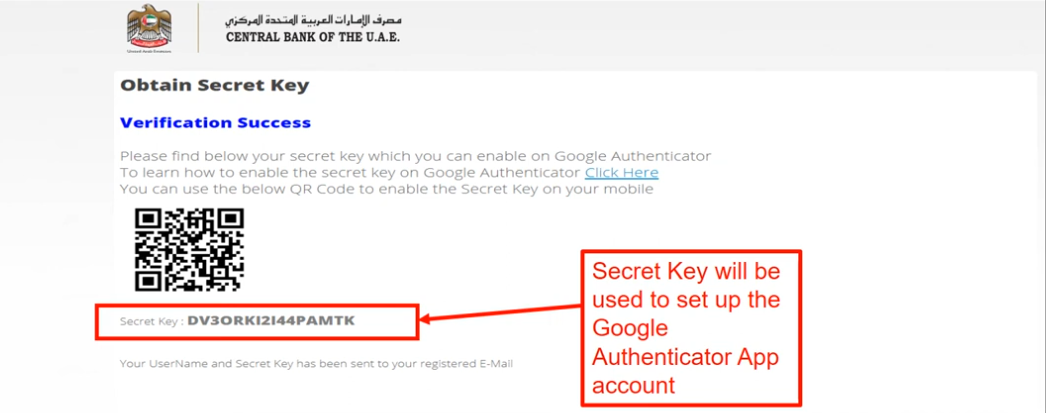

Once you’ve completed the above steps, the following screen will load.

Step 6: Set up Google Authenticator app

Open the Google Authenticator app on your phone, select ‘Begin’, choose whether you want to scan the QR code being displayed on the computer screen or if you want to enter the secret key manually, and remember to set the account name as ‘goAML Portal’. Then, select ‘Add’ and once you see that the account has been added, tap the three vertical dots in the top right corner, tap ‘Settings’, then ‘Time correction for code’, and then ‘Sync now’.

Then, you will receive the following email. You follow the link contained in this email to sign in to SACM.

Stage 2: goAML Registration

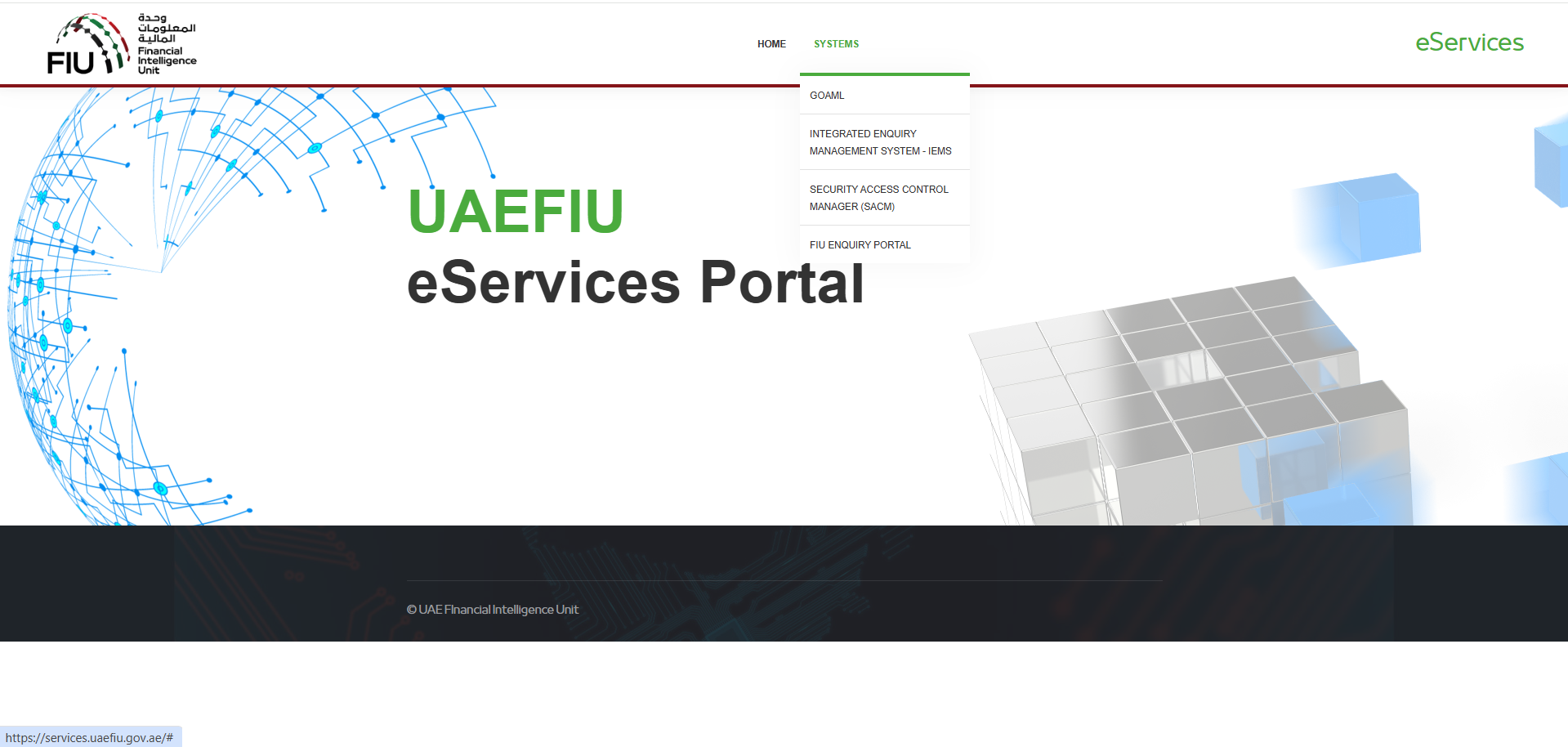

Step 1: Open goAML portal and log in

Click here to open the UAE FIU website. Then, click on ‘goAML’.

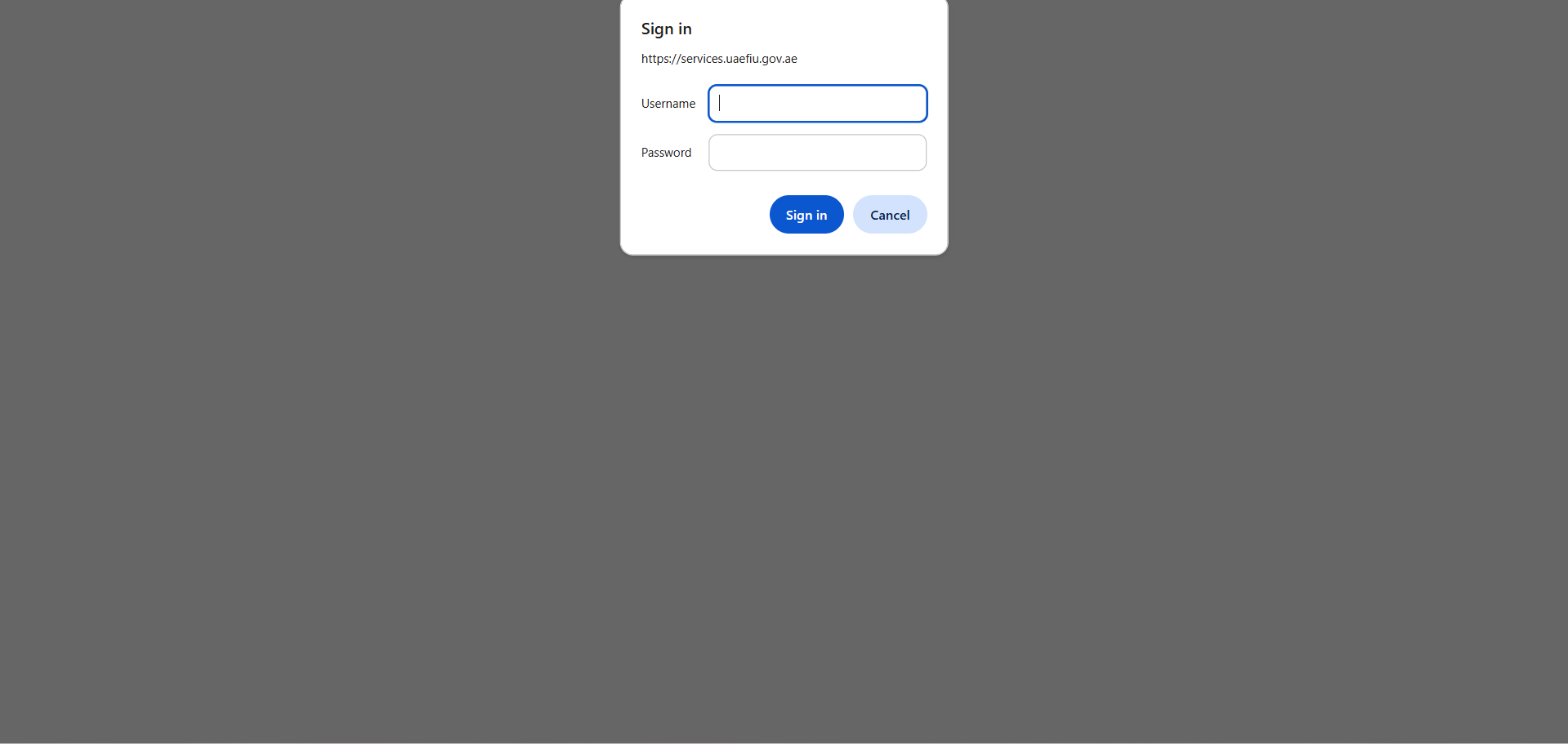

In the pop-up window, enter the username shared via email from the ID ‘webmaster@eservices.centralbank.ae’ and the password from your Google Authenticator app.

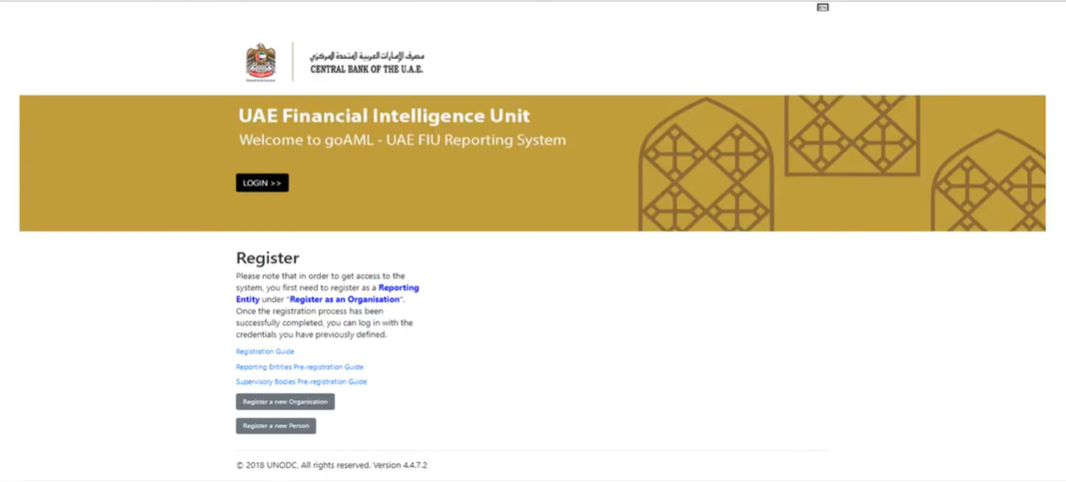

Step 2: Register organization

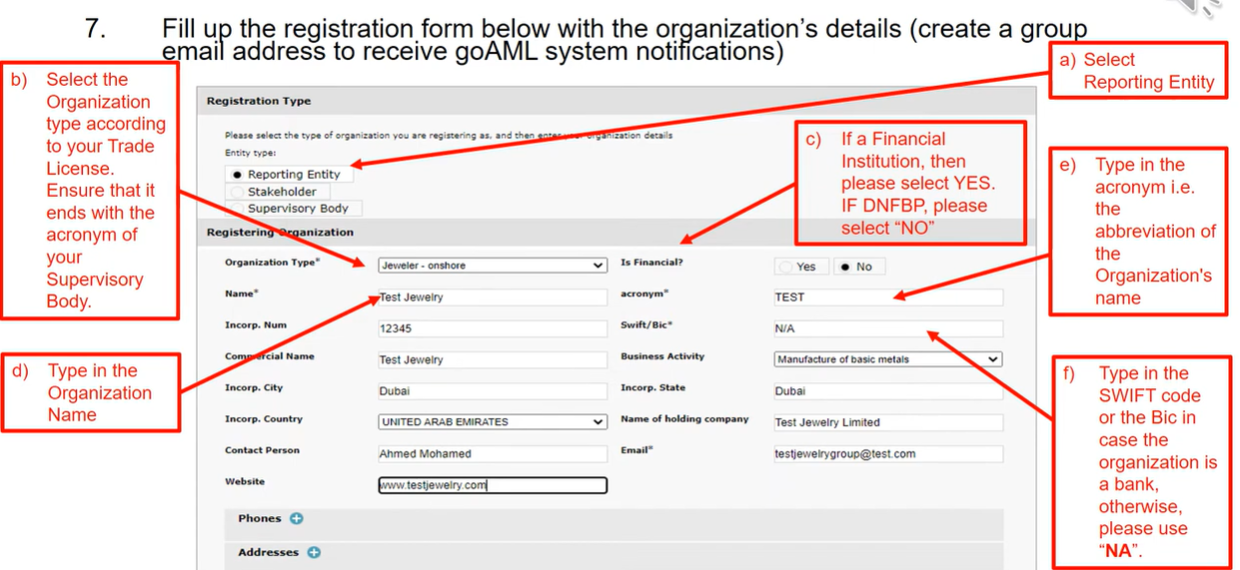

Click on ‘Register a new organization’ and fill up the registration form.

Ensure that the selected organization type is consistent with your trade license and ends with the acronym of your supervisory body.

If you are registering as a DNFBP, answer ‘No’ for the question ‘Is financial?’; otherwise, answer ‘Yes’. Then, fill all the other details in a manner consistent with your trade license.

Ensure that the contact person is your organization’s MLRO.

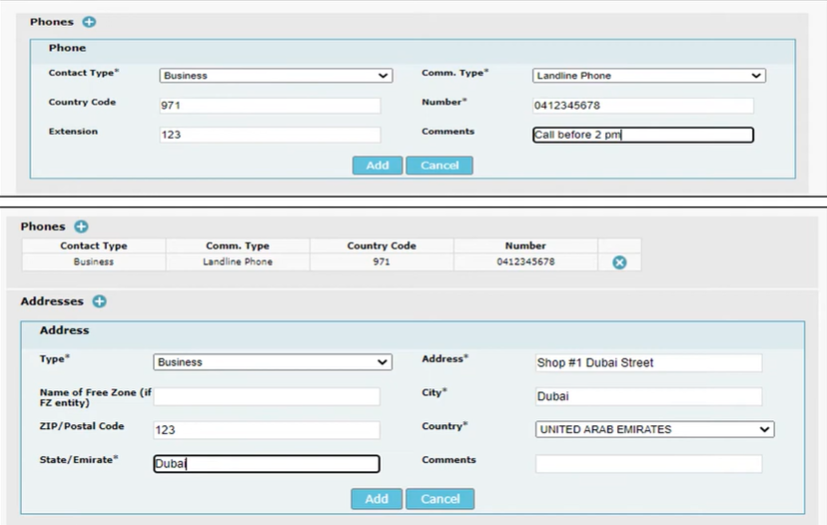

In the same manner, you will need to fill in phone and address details. In the comments, you can request the authorities to call you at specific time slots.

Step 3: Fill in MLRO details

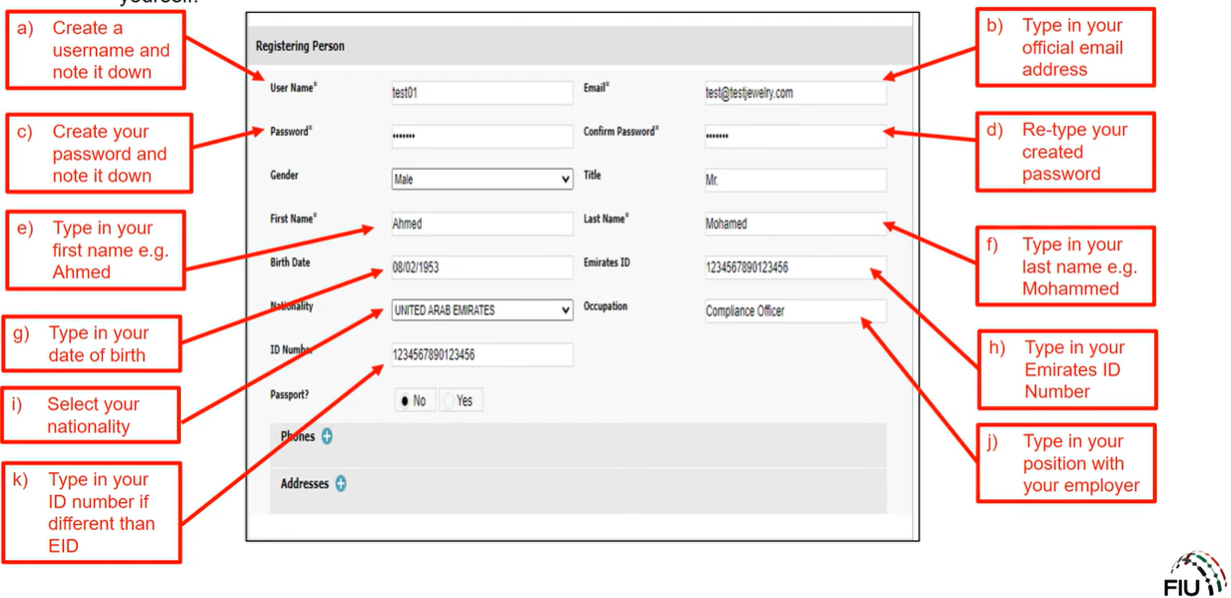

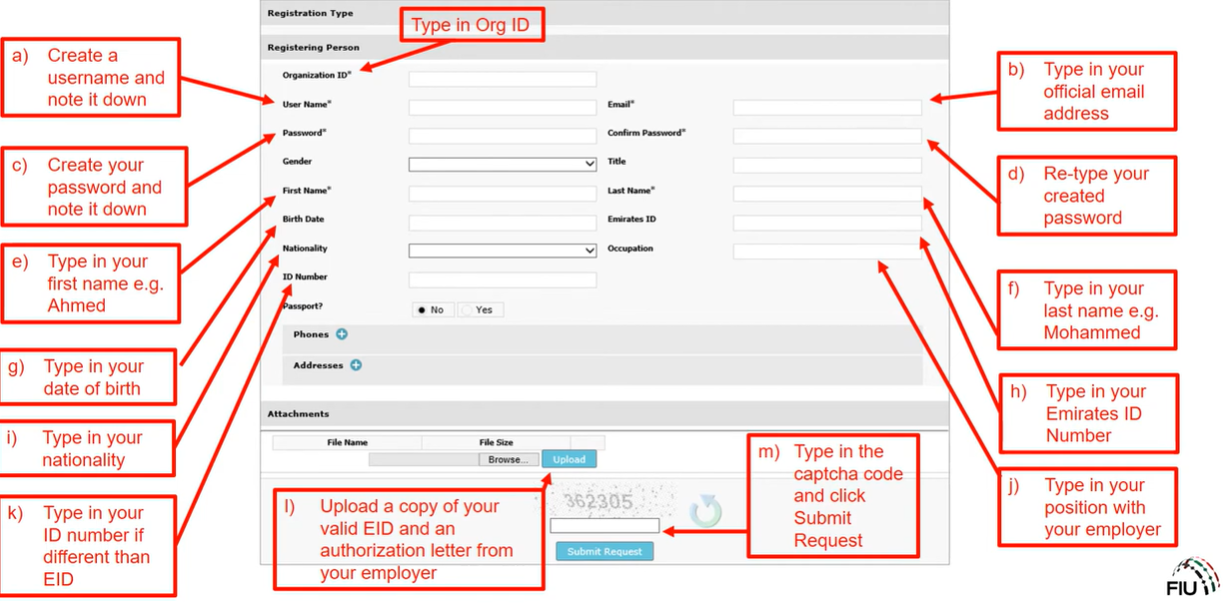

You must then create a username for the registering person, note it down securely, and retain it for future reference. In the ‘Email’ field, enter the registering person’s official email address.

Create a password, confirm it, and then fill in the personal details, including first name, last name, date of birth, and Emirates ID. Continue by entering nationality, occupation, and ID number.

If passport details are available, select Yes next to the passport option. This will open an additional screen where the passport details must be entered.

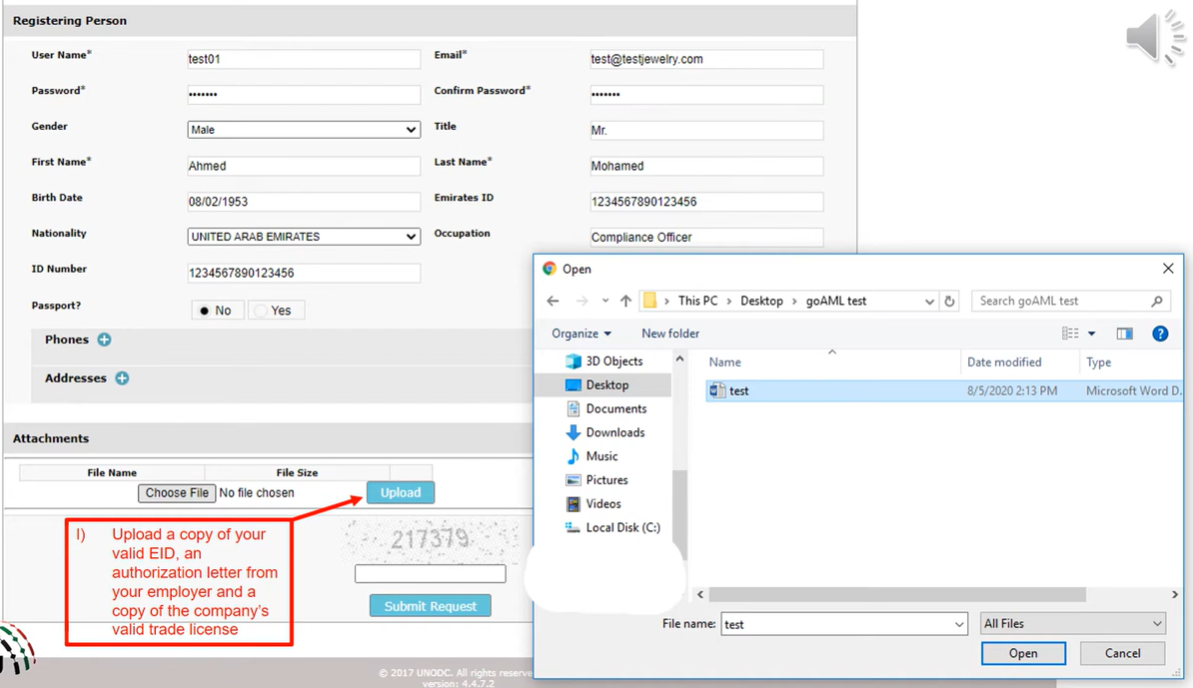

The registering person must then upload the required supporting documents, which include:

- A valid Emirates ID

- A copy of the authorization letter issued by the employer

- A copy of the company’s valid trade license

Before submitting the request, enter the captcha code displayed on the screen. If the code is unclear, refresh it and re-enter the new code before clicking ‘Submit’.

goAML Registration Approval and Follow‑Up

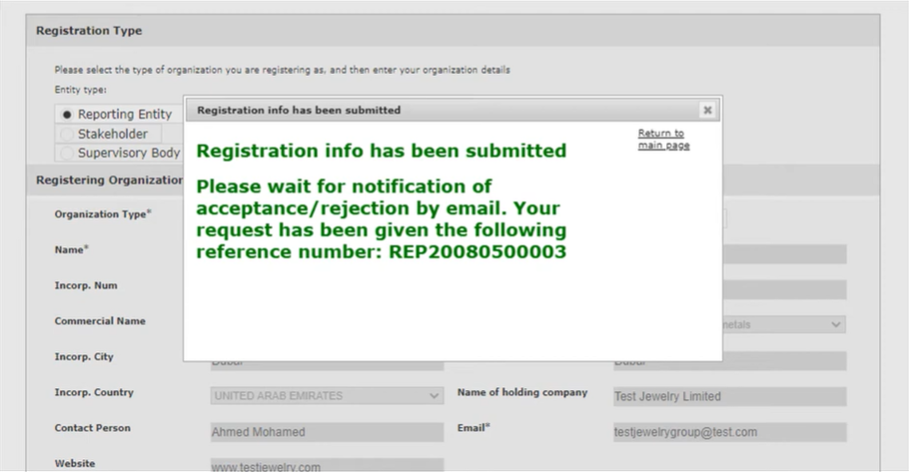

Once the registration request is submitted, a ‘Registration Submitted’ confirmation screen will appear. This screen will display a registration reference number. This reference number is important and must be retained for any registration-related inquiries with the supervisory body.

Following submission, the supervisory body will review and verify the registration request along with the uploaded supporting documents.

Based on this review, the goAML registration will either be approved or rejected.

Upon registration approval, you will receive a system notification email containing your Organization ID. This Organization ID is critical and will be required to register additional users under the same organization.

Bonus: Additional goAML User Registration

If the organization requires multiple users in addition to the MLRO, each additional user must register individually using the Organization ID provided in the approval notification email.

- Additional users should log in to the goAML portal and click on ‘Register a new person’ from the home page.

- A registration form will appear. At the top of the form, enter the Organization ID obtained from the MLRO.

- Repeat step 3 from Stage 2 for the new user

Bonus: Additional User Approval

The MLRO, who acts as the admin user, is responsible for approving or rejecting all additional user registration requests.

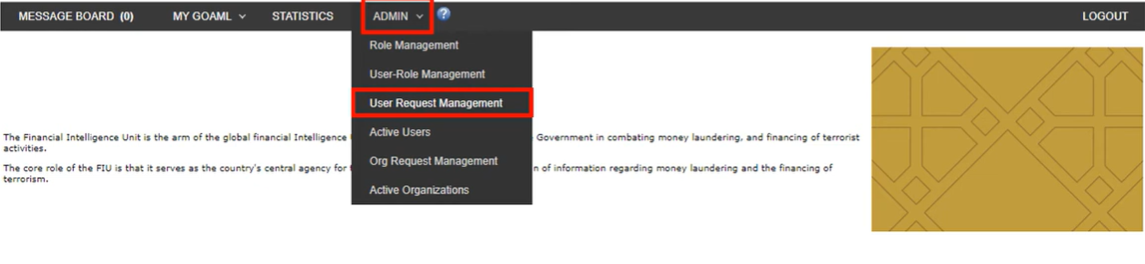

- Navigate to the Admin menu and select User Request Management. The user request management screen will appear.

- Click on the blue hyperlink or the ‘i’ icon next to the relevant request to view the user’s details. Review the submitted information carefully.

- If the details are satisfactory, click Finalize to approve the request.

OR - If the details are unsatisfactory, click Reject, enter the reason for rejection in the comments box, and submit the decision.

- If the details are satisfactory, click Finalize to approve the request.

Penalties for Non‑Compliance with AML Requirements

Penalties and fines related to anti-money laundering laws in the UAE are governed by Chapter 12 of Federal Decree Law No. (10) of 2025. This law outlines the following penalties for violating anti-money laundering laws.

| Violation | Imprisonment | Fine | Additional Penalties |

|---|---|---|---|

| Money Laundering (Article 26.1) | 1-10 years | AED 100,000 – 5 million or value of Criminal Property (whichever is greater) | – |

| Money Laundering with Aggravating Circumstances (Article 26.2) ● Exploiting influence/authority ● Through Non-Profit Organization ● Through organized criminal group ● Predicate offence involves specific crimes ● Repeat offense | Temporary | AED 1 million – 10 million or twice the value of Criminal Property (whichever is greater) | – |

| Financing of Terrorism (Article 26.3) | Life imprisonment or temporary imprisonment (minimum 10 years) | AED 1 million- 10 million or twice the value of Criminal Property (whichever is greater) | – |

| Proliferation Financing (Article 26.4) | Temporary | AED 1 million – 10 million or twice the value of Criminal Property (whichever is greater) | – |

| Attempt to commit Money Laundering, Financing of Terrorism, or Proliferation Financing (Article 26.5) | Same as consummated crime | Same as consummated crime | – |

| Legal Person – Money Laundering, Financing of Terrorism, or Proliferation Financing (Article 27.1) | – | AED 5 million – 100 million or value of Criminal Property (whichever is greater) | ● For Financing of Terrorism/Proliferation Financing: Mandatory dissolution and closure ● For Money Laundering or Article 10 violation: Court may order dissolution and closure |

| Legal Person – Violations of Articles 28, 29, 30, 32, 33, 34, or 35 (Article 27.2) | – | AED 200,000 – 10 million | – |

| Person Responsible for Actual Management of Legal Person (Article 27.5) | Imprisonment and fine, or one of the two penalties | Applies if persons were aware of the crimes and the crimes occurred due to breach of their duties | |

| Violation of Article 18 – (deliberately or through gross negligence) (Article 28) | Imprisonment and fine of AED 100,000 – AED 1 million, or one of the two penalties | – | |

| Tipping off or informing other people regarding transactions under review – violation of Article 24 (Article 29.1) | Imprisonment and fine of minimum AED 50,000, or one of the two penalties | – | |

| Breach of duties managing Funds or violation of Seizure/Freezing orders (Article 29.2) | Imprisonment and fine of minimum AED 50,000, or one of the two penalties | – | |

| Crimes in connection with Article 29.1 or 29.2 resulting in inability to seize Proceeds or their destruction/loss of value (Article 29.3) | Minimum 1 year | Equal to value of Proceeds (minimum AED 100,000) | – |

| Possessing/concealing/conducting Transaction in Funds with sufficient indications of illegitimate source (Article 30.1) | Minimum 3 months and fine of minimum AED 50,000, or one of the two penalties | Court shall order Confiscation per Article 31 | |

| Promoting/offering/dealing in totally anonymous Virtual Assets or unlicensed accounts/technologies (Article 30.2) | Minimum 3 months and fine of minimum AED 50,000, or one of the two penalties | Court shall order Confiscation per Article 31 | |

| Violation of Article 20 (Article 32) | Imprisonment and fine of AED 200,000 to 10 million, or one of the two penalties | – | |

| Violation of Targeted Financial Sanctions instructions (Article 33) | Imprisonment and fine of minimum AED 20,000, or one of the two penalties | – | |

| Violation of Article 10, refusal to provide information, concealing information, or providing false information (Article 34) | Imprisonment and fine, or one of the two penalties | Court may order Confiscation of seized Funds | |

| Providing false/misleading information concerning Beneficial Owner (Article 35.1) | Imprisonment and fine of minimum AED 20,000, or one of the two penalties | – | |

| Unlawfully enabling another to benefit from account with knowledge of misuse (Article 35.2) | Imprisonment and fine, or one of the two penalties | – | |

| Violation of Article 19 – Clause 1 and paragraphs A, C, D of Clause 2 (Article 35.3) | Imprisonment and fine of minimum AED 10,000, or one of the two penalties | – | |

| Foreigner convicted of Money Laundering or felonies under this Decree (Article 36.1) | Custodial sentence | – | Mandatory deportation |

| Foreigner convicted of other misdemeanors under this Decree with custodial penalty (Article 36.2) | Custodial penalty | – | Court may order deportation or impose deportation in lieu of custodial penalty |

Note

In certain circumstances, your penalty might be waived or lessened if you provide information that leads to identification/apprehension of perpetrations, establishes proof of crime or seizure of criminal property.

Conclusion

goAML registration is the first step in compliance with UAE’s anti-money laundering regulations for UAE businesses. While the registration process involves multiple stages, following the steps outlined in this guide will help ensure an unhindered goAML registration experience.

Given the significant penalties for non-compliance, ranging from AED 50,000 to AED 5 million, timely registration is essential.

Need expert assistance with your goAML registration? Contact skrooge.ai today for swift and error-free goAML registration.

Disclaimer: This article is meant purely for informational purposes and is not legal advice.

FAQ

The United Nations Office on Drugs and Crime (UNODC) developed the goAML system to track suspicious transactions and prevent money laundering and terrorism financing. The UAE is the first Gulf country to adopt the goAML system, and hence, all Designated Non-Financial Businesses and Professions (DNFBPs) must register for goAML.

goAML registration is mandatory for Designated Non-Financial Businesses and Professions (DNFBPs), which may include real estate firms, auditing or accounting firms, precious metals and stones dealers, trusts, and company service providers.

To register for goAML, you will need your passport, resident visa, Emirates ID, commercial trade license, and a letter authorizing you to represent the company you are registering.

The Service Access Control Manager (SACM) registration is a preliminary step to goAML registration. When you complete this step, you will have the username and secret key for the Google Authenticator app. On this app, you can view the password for accessing the goAML portal. This password changes every minute.

If your goAML registration is rejected at step 1, i.e., the Service Access Control Manager (SACM) registration stage, you should resubmit your SACM application on the UAE Financial Intelligence Unit’s (FIU) website. However, if your goAML registration is rejected at step 2, you do not need to repeat the SACM registration. You can directly reapply for goAML registration.

goAML registration is mandatory under UAE law, and failing to meet this requirement attracts a penalty of AED 50,000.

Thank you!

We've received your request and will get back to you shortly.