External audit reports enable businesses to build credibility with investors, partners, and financial institutions. They provide an independent assessment of your company’s financial statements, giving stakeholders confidence that your financial records accurately reflect your business’s true position.

In the UAE’s competitive business environment, where stakeholders place a lot of weight on transparency and compliance, a clean audit opinion can open doors to funding opportunities and strengthen business relationships.

The first step in achieving a clean or unqualified audit opinion is understanding the different types of audit reports and what they mean for your business. That’s exactly what this article is all about.

We will also discuss the key elements of audit reports, different types of audits, UAE-specific bookkeeping requirements, and how businesses can prepare for audits. Read on to know more!

What Is an Audit Report?

An audit report is essentially the summary of an investigation into a company’s financial statements. It is meant to inform the reader of any deficiencies in financial recordkeeping or any fraudulent accounts or transactions. Typically, auditors begin by examining whether the company adhered to the relevant accounting standards. In the UAE, since the passing of Federal Law No. 2 of 2015, companies are expected to follow the International Financial Reporting Standards (IFRS).

It’s not feasible for auditors to examine every single transaction. Instead, they select a sample of transactions basis on risk weight and focus on any key matters highlighted in previous audit reports.

While financial audits can refer to internal audits performed by in-house accountants, generally, for tax compliance or investor relations-related purposes, external audits are needed.

Types of Audit Opinion

The four types of audit opinion a business can receive are:

1. Unqualified opinion

The best possible outcome of an audit is an unqualified opinion, sometimes also called a clean audit opinion. This signifies that the auditor found no significant errors or violations of accounting principles. Such audit reports give investors confidence in the financial reporting of your company.

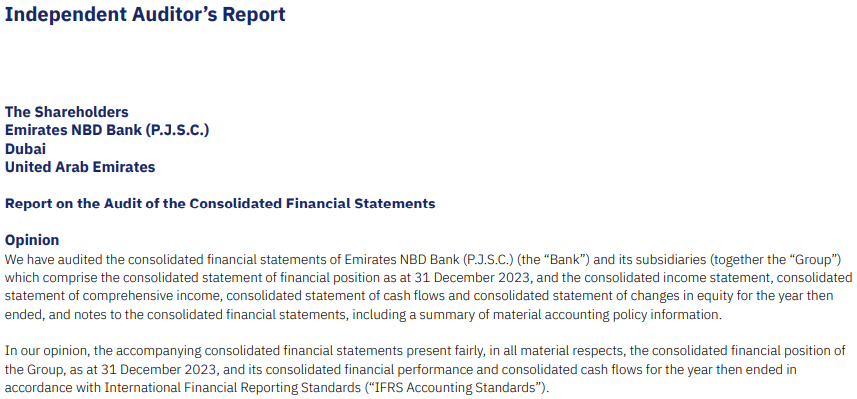

Example of an unqualified audit report

Emirates NBD, one of the biggest banks in the UAE, received an unqualified audit opinion on its financial statements for the year ended on 31st December 2023. The auditor who issued this opinion was Deloitte & Touche.

In this audit report, the auditor stated that:

- They received all the necessary information

- The bank prepared financial statements in compliance with UAE law

- Bookkeeping was accurate

2. Qualified opinion

When the auditor uncovers significant but contained issues in the financial records, they will issue a qualified opinion. Such an audit report will contain wording like “We found financial statements to fairly represent the company’s financial position except for…” followed by the specific issues that were encountered.

A key thing to note is that qualified reports are issued for companies where inconsistencies or errors are limited to certain accounts or transactions and do not spread across all financial records.

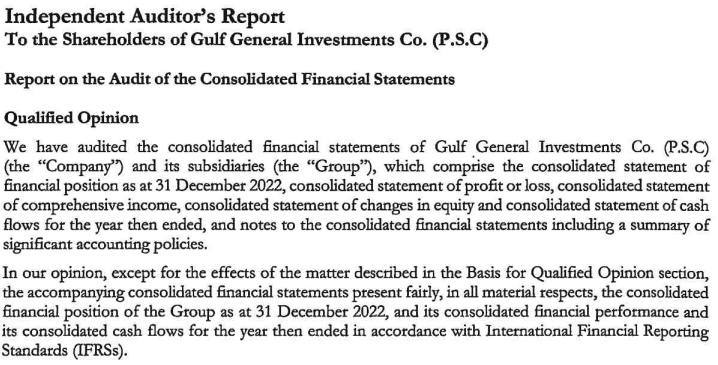

Example of a qualified audit report

Grant Thornton issued a qualified opinion on Gulf General Investments’ financial statement for the year ending on 31st December 2022.

Two key issues pointed out in this audit report were:

- The company failed to record its interest costs since 1st January 2020. This was a significant oversight since interest costs amounted material amounts both in 2021 and in 2022.

- The auditor didn’t find sufficient audit evidence to confirm that the company settled a part of its borrowing by disposing of shares and properties pledged to the bank / lender.

3. Adverse opinion

When the errors in financial records are severe and persistent throughout, the auditor will have no choice but to issue an adverse opinion. Such audit reports will directly mention that the auditor doesn’t find the financial statements to be a true and fair view of the company’s financial health. Receiving an adverse opinion is a serious problem as it sets the alarm bells ringing for lenders and business partners. Hence, you must address the issues outlined in such audit reports immediately.

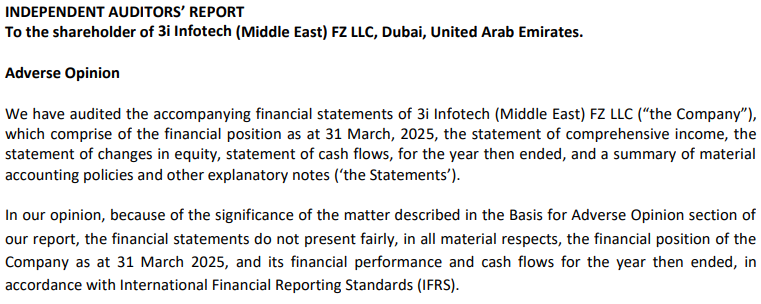

Example of an adverse audit report

3i Infotech (Middle East) FZ-LLC, Dubai received an adverse opinion from HAA Auditing for its financial statements for the year ended on 31st March 2025.

HAA Auditing provided two reasons for its adverse opinion in the audit report, which were:

- Auditors were unable to verify the recoverability of receivables from related parties, which amounted to hundreds of millions of AED.

- The company had a negative net worth at the end of the audit period. If the related parties’ receivables are considered as 100% non-recoverable, the net worth drops even more, casting significant doubt on its ability to continue operations.

4. Disclaimer of opinion

A disclaimer of opinion means that the auditor declines to express an opinion on the company’s financial statements. This typically occurs due to a lack of sufficient evidence or transparency, making it impossible for the auditor to form a reliable conclusion. Such situations often arise from communication breakdowns between the auditor and the company or from limitations imposed on the audit process.

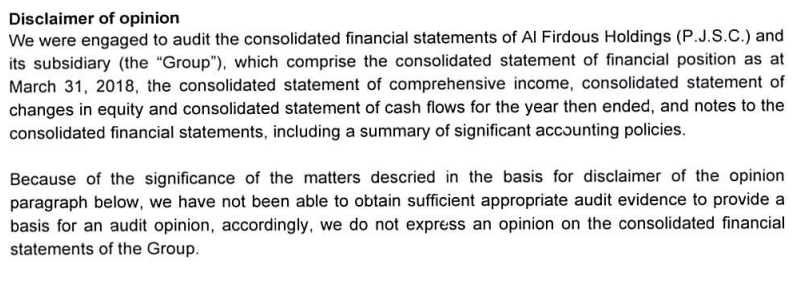

Example of a disclaimer of opinion audit report

Rödl Middle East issued a disclaimer of opinion on the financial statements of Al Firdous Holdings for the year ending on 31st March 2018.

Lack of evidence in two key areas led to the disclaimer of opinion being issued in this audit report:

- The full consideration for the sale of a subsidiary was due in 2011, but remained outstanding at the date of closing. The auditor was unable to verify the recoverability of this consideration and whether any provisions should have been taken against any related risks.

- The company paid an advance through a related party, to purchase land in Dubai, but no such properties had yet been assigned to the company.

To summarize…

Here’s what each audit report signifies:

- Unqualified report

No significant errors found - Qualified report

Significant but contained errors found - Adverse report

Severe errors found - Disclaimer of opinion report

Lack of transparency/audit evidence

Key Elements of Audit Reports

The audit report format is heavily standardized in order to meet stakeholder expectations. If you check any audit report of companies listed in the UAE, you will find that the following common elements are found in most audit reports:

1. Opinion

Auditors begin the audit report by explaining the scope of the audit. For instance, audit reports included in annual reports would state that the auditors investigated that year’s financial statements, comprising the statements on comprehensive income, changes in equity, and cash flows, accounting policies, and explanatory notes.

Then, the auditor’s opinion is expressed while briefly touching upon the basis.

2. Basis for Opinion

When the auditor’s opinion is qualified, adverse, or they have issued a disclaimer of opinion, they will outline the key issues uncovered/encountered during the audit. However, in the case of unqualified opinions, this section will be limited to brief explanations on how exactly the audit was conducted, which standards were followed, and disclosures of any relations to the company being audited.

3. Key Audit Matters

In audit reports for listed companies, auditors provide a detailed outline of all areas of concern that had to be addressed in the ‘key audit matters’ section.

For instance, if a business has significant exposure to foreign exchange risks, the auditor will explain the extent of the exposure and how exactly these concerns are being addressed, how the management plans to mitigate these risks, and whether enough evidence was found for the effectiveness of management’s plans.

4. Auditor’s Responsibilities

The section on the auditor’s responsibilities provides detailed explanations of the scope of the audit and the audit process.

5. Management’s Responsibilities

Here, the auditors will outline the extent of the management’s responsibilities. In the context of financial reporting, the management’s responsibilities typically include accurate bookkeeping and preparation of financial statements.

6. Report on Other Legal and Regulatory Requirements

This section outlines whether the company’s financial reporting meets legal and regulatory standards of the jurisdiction in which it operates. Reading it can help investors and other stakeholders understand risks related to administrative penalties and the potential of tax-related audits in the future.

7. Emphasis of Matter

Any information that is crucial to understanding the financial statements is discussed in the emphasis of matter section. The matters discussed in this section are not necessarily errors or misrepresentations of facts. But if an outsider misses this important context, they may end up misunderstanding the financial statements.

8. Other Information

Typically, the scope of an independent auditor’s report is limited to the financial statements. Any other supplemental information, such as the management’s discussion and analysis, may be referred to for finding inconsistencies, but does not need to be audited. The other information section addresses all such information. You will typically find this section in large combined reports like annual reports.

9. Other Matters

This section discusses financial reporting-related issues that go beyond the scope of the audit. For instance, if a different auditor had passed an adverse opinion in a prior accounting period, this is where that information will typically be disclosed, if the current auditor deems it relevant.

Common Types of Audits in the UAE

In the UAE, you may encounter the following types of audit reports:

1. External audit reports

External audit reports are also known as independent auditors’ reports since they are produced by firms/persons unrelated to the company. So, by definition, external audits for a company cannot be produced by that company’s employees, directors, or any other stakeholders. Thus, external audits provide an unbiased assessment of financial records. Typically, the scope of external audits is limited to the financial statements of a certain period.

Statutory audits are simply external audits required by law (or statutes). One example of this in the UAE context would be the Federal Decree Law on Commercial Companies, requiring all mainland companies to maintain audited accounts so that these accounts can be shared as and when partners/shareholders request them.

2. Internal audit reports

When an in-house team audits a company, the audit is called an internal audit. The scope of these audits is not limited to financial records and can include investigations into operational efficiency and alignment of key processes with company policies. Internal audit reports play a key role in helping the management identify compliance and operational risks. Or, they can also help the management find evidence for suspicions, enabling them to build risk mitigation strategies proactively.

3. Tax-authority audits

Authorities may choose to audit companies if they suspect misreporting of key facts and figures to dodge tax obligations. In the UAE, companies face two key tax obligations, which are corporate tax (CT) and value added tax (VAT). As a result of these audits, if any material misstatements are discovered, companies may face penalties.

Legal & Regulatory Requirements in the UAE

This section contains a brief discussion of the UAE’s legal and regulatory requirements regarding financial reporting:

1. International Financial Reporting Standards

The Commercial Companies Law requires all companies to prepare financial accounts as per International Financial Reporting Standards (IFRS), a set of internationally recognized accounting principles. This promotes standardization of key accounting principles related to matters like asset valuation and calculation of profits/losses, reducing the time spent understanding accounting policies and enabling faster interpretation and comparisons.

2. Financial year

Companies are required to establish financial years consisting of 12 consecutive months, with every financial year beginning immediately after the preceding one ends. So, if your financial year ends on 31st March 2025, the next financial year must begin on 1st April. But the first financial year can be of 6 to 18 months, starting from the registration date.

3. Bookkeeping

The Commercial Companies Law requires companies to retain financial records for at least 5 years, but if an entity falls under the definition of a taxable person under the Corporate Tax Law, it must maintain records for at least 7 years. Electronic records are permitted if they are in the prescribed format. Also, the record retention requirements extend to individual transactions and not just high-level summaries for accounting periods.

4. Financial statements

At the end of each financial year, companies must prepare financial statements, generally comprising balance sheets, income statements, and cash flow statements. The following types of entities are required to have these financial statements audited annually for the sake of regulatory compliance:

- Corporate tax-rated audit requirements apply to:

- Taxable persons that are not part of a group and generate revenue exceeding AED 50 million

- All Qualifying Free Zone Persons

- Tax groups

- Some free zones require annual audited financial statement submission (timing and whether it affects renewal varies by zone, e.g. DMCC within 6 months; RAKEZ requires annual submission but not at renewal)

- UAE branches of foreign companies may also be required to have audited FS depending on Corporate Tax thresholds and/or the licensing authority’s rules

How to Prepare for a Smooth Audit

Here’s a quick audit preparation guide for UAE companies:

- Organize your financial records early

Ensure all invoices, receipts, bank statements, and transaction records are properly filed and easily accessible. Don’t wait until the audit begins to locate missing documentation. - Review your accounting policies

Verify that your bookkeeping practices align with IFRS standards and that you’ve applied accounting principles consistently throughout the financial year. - Strengthen internal controls

Implement clear approval processes for transactions, segregate financial duties among team members, and establish a review system to catch errors before the audit. - Reconcile all accounts

Conduct a review of bank reconciliations, inventory counts, and accounts receivable/payable well before the audit starts to identify and resolve discrepancies. - Create a responsibility matrix

Assign specific team members to handle auditor queries in their areas of expertise, ensuring faster responses and smoother communication. - Set realistic timelines

Schedule the audit during a less busy period if possible. For instance, if your business peaks during year-end, you could choose 31st March as your accounts closing date to avoid shuffling between day-to-day operations and responding to auditor queries.

Conclusion

By establishing robust internal controls, you can switch from reacting to external audit pressure to proactively using audits for strengthening credibility and stakeholder trust.

Ultimately, consistent financial transparency, rigorous compliance, and the intelligent use of modern technology are what enable businesses to achieve unqualified audit outcomes.

skrooge.ai’s tax and accounting package is built to support this shift. Our team ensures that all key facts and figures are recorded in compliance with UAE laws and remain consistent across tax filings and records related to inventory and cash flow.

Take control of your audit readiness and turn compliance into a competitive advantage by adopting skrooge.ai today!

FAQs

Unqualified, qualified, adverse, and disclaimers of opinion are the four types of opinions expressed in an external auditor’s report. They reflect how accurately financial statements capture the company’s financial status.

An unqualified auditor’s opinion signifies that the auditor found no material misstatements or issues. On the other hand, qualified reports mean that significant issues were found, but they were limited to certain transactions or accounts, and they do not compromise the accuracy of the entirety of the organization’s financial statements.

Not all companies require audits, but many do. Audited financial statements are mandatory for taxable persons generating revenue over AED 50 million, Qualifying Free Zone Persons, tax groups, some free zone companies (RAKEZ, DMCC, etc.), and UAE branches of foreign companies in certain cases. The Commercial Companies Law also requires companies to share audited accounts with shareholders and partners upon request.

Internal audits are conducted by your company’s own employees and can cover financial records, operational efficiency, and policy compliance. External audits are performed by independent audit firms with no connection to your company, focusing specifically on financial statements to provide an unbiased assessment that stakeholders can trust.

Every audit report contains the auditor’s opinion, basis for that opinion, key audit matters (for listed companies), auditor’s responsibilities, management’s responsibilities, report on legal and regulatory compliance, emphasis of matter (if applicable), and sections on other information and other matters that provide additional context.

Start by organizing financial records early, reviewing accounting policies for IFRS compliance, strengthening your company’s internal controls, reconciling all accounts, creating a responsibility matrix for your team, and setting realistic timelines. Proper preparation significantly reduces audit duration and helps identify potential issues before auditors do.

Thank you!

We've received your request and will get back to you shortly.