VAT has been part of doing business in the UAE since January 1, 2018, and the Federal Tax Authority (FTA) aims to build systems that make compliance straightforward.

Once you’re registered, you can legally claim input VAT, and file your VAT return through EmaraTax, the FTA’s online platform to simplify the whole taxation process.

However, with the new UAE VAT laws and tax procedures amended under Federal Decree-Laws No. 16 & 17 of 2025, and in effect starting 1st of January of 2026, it is natural for businesses to feel confused about what still applies, what has changed, and how to file correctly going forward.

Filing on time helps you avoid penalties, maintain a clean record, and keep your cash flow predictable. It also makes you more credible when working with partners and clients. Most mistakes arise because of timing or admin issues. We aim that by the end of this guide, VAT filing will feel like a familiar routine that protects your cash flow and reputation.

In this guide, we will walk you through how VAT filing in the UAE works based on real experience supporting businesses. And if you want an easier way to handle VAT, skrooge.ai can help you familiarize yourself with understanding VAT, and automate your preparation to reduce errors and remind you before each deadline.

NOTE:

New Federal Decrees and consequent changes effective 1 Jan 2026 affect refund limits, input tax recovery criteria, and reverse-charge invoicing rules — meaning you should plan ahead in your 2025 filings to avoid losing recoverable amounts.

What is VAT Return or VAT Filing?

A VAT return is the form your business files with the Federal Tax Authority (FTA) to report its VAT activity for a specific period. It shows the VAT you collected from customers, the VAT you paid on business costs, and the final amount owed to the FTA or eligible for refund.

VAT Filing is simply the process for preparing and submitting your VAT return, in line with obligations set by tax laws in effect after successful VAT registration.

In the UAE, VAT returns are submitted online through the FTA portal and can be filed either by the business itself or by someone authorized to act on its behalf, such as a tax agent or advisor.

At its core, a VAT return is the FTA’s way of checking in on your business activity during reporting cycles. It is essentially a structured summary of everything you charged and everything you paid in VAT, all wrapped into one report.

A VAT return includes three key pieces:

- Output VAT VAT charged on sales or otherwise, the VAT you collect from customers on taxable supplies.

- Output VAT is typically included in invoices when selling goods or services after registering for VAT. In most cases, this applies to sales made to customers.

- For zero-rated supplies, this also needs to be reported to the FTA. Once the taxable supply is made as per VAT Laws, the business must report the VAT charged in the return for that period.

- Input VAT VAT you’ve paid on legitimate business expenses or VAT you were charged for by others (e.g. VAT charged on office rent, utilities, supplies, VAT on imported goods declared in customs).

- In short, input VAT is the VAT included in the price you pay when purchasing goods or services for your operations.

- Net VAT The final amount you either owe the FTA (VAT payable) or can claim back (VAT Refundable).

- If your business is registered for VAT, you may be able to recover this VAT from the Federal Tax Authority (FTA), provided certain conditions are met.

In practice, this means:

- you must hold a valid tax invoice or supporting document that clearly shows the VAT charged on the purchase or import and the purchase is used to make taxable/zero-rated supplies

- payment is not a condition to claim input VAT in the first instance. However, if the supplier is not paid within 180 days (6 months) from the date of supply, you must adjust (reduce) the input VAT previously recovered in the relevant VAT return, and

- when payment is made after 180 days, you may reclaim input VAT again to the extent actually paid (full or partial), supported by payment evidence and the original tax invoice.

Once these conditions are satisfied, the recoverable VAT can be included in your VAT return as a deduction for the relevant reporting period.

IMPORTANT NOTE

If your business is registered for VAT and holds a TRN, filing this return is not optional. Even if you had no transactions in a tax period, the FTA still requires a nil return. To put it simply, even zero transactions in a taxable period require a nil return.

What is the Reverse Charge Mechanism?

Reverse Charge Mechanism means the responsibility for reporting VAT shifts from the seller to the buyer. Instead of the supplier charging VAT on the invoice, the business receiving the goods or services calculates and reports the VAT itself in its tax return. This usually applies to imports or specific business-to-business transactions and helps ensure VAT is properly accounted for even when the supplier isn’t registered locally.

Under the reverse charge mechanism, the role is reversed — the buyer accounts for the VAT instead of the supplier.

Why this exists in the UAE

The reverse charge mechanism ensures VAT is collected even when the supplier:

- is outside the UAE and not required to register for VAT in the UAE, or

- is not obliged to charge VAT because of the nature of the transaction, yet the supply is deemed taxable under UAE rules.

- To simplify, the shift in responsibility falls on the buyer

How It Works

Imagine you are a UAE VAT-registered business:

- You import services or goods from a supplier that isn’t VAT-registered in the UAE (e.g. a foreign consultant or overseas vendor).

- The supplier doesn’t charge VAT because they aren’t registered in the UAE.

- Under reverse charge, you calculate the VAT yourself (at the standard UAE rate) and include it in your VAT return as if you were both the supplier and the recipient.

- This is reported in your VAT return (form VAT 201) using the reverse-charge sections. Because output and input VAT often cancel out, there’s no extra cash to pay, but the VAT is legally accounted for.

Typical Scenarios Where Reverse Charge Applies

In the UAE VAT tax system, RCM commonly applies to:

- Imported services or imported goods where the supplier is outside the UAE.

- Certain designated domestic supplies (e.g., hydrocarbons, electronic devices, precious metals), where the recipient rather than the supplier must account for VAT only if certain conditions are met.

These specifics come from VAT law and executive regulations (Article 48 of Federal Decree-Law No. 8 of 2017 and related Cabinet Decisions).

To understand how the reverse charge supplies are treated in VAT return, you can refer to this table:

| Output VAT Scenario | Is the reverse charge treated as a deemed supply? | What the business must do |

|---|---|---|

| Imported services from non-UAE supplier | Yes | Report VAT as if you supplied it to yourself |

| Imported goods from abroad | Yes | Account for VAT on imports in your return |

| Certain local B2B sectors (e.g., electronics, oil, metals) | Yes (in specified cases) | Buyer accounts for VAT, not seller |

| Standard local sales | No | Supplier charges and reports VAT on sales |

NOTE: What You Have to Do Under RCM

To stay compliant, you must:

- Identify transactions where reverse charge applies (imports, specified local supplies)

- Calculate VAT on those transactions in your VAT return

- Use supporting documentation instead of self-invoices when possible (from 2026)

- Retain records (invoices, contracts, customs documents etc.) for audit purposes

Once you understand these basics, the rest of the VAT return filing process becomes far more manageable. In principle, UAE filing is more about accurate reporting, ensuring consistency, clarity, and compliance.

Summarized filing process for VAT returns

For each tax period, a VAT-registered business must submit a VAT return. It must include the following details:

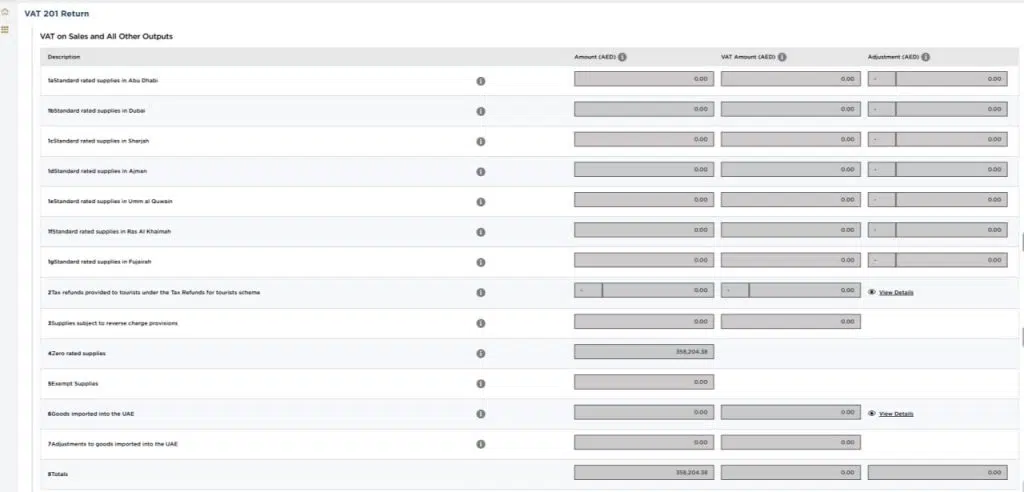

With respect to sales and other outputs, the following information needs to be reported:

- supplies of goods made which are subject to standard rate of VAT must be reported separately Emirate wise;

- supplies of goods and services received by the Taxable Person which are subject to the reverse charge provisions;

- supplies of goods and services made which are subject to the zero rate of VAT;

- supplies of goods and services made which are exempt from VAT;

- goods imported into the UAE and have been declared through UAE customs; and

- tax refunds you have provided to tourists under the Tax Refunds for Tourists Scheme, if you are a retailer and provide tax refunds to tourists in the UAE under the official tourists refund scheme;

- adjustments to goods imported into the UAE and which have been declared through UAE Customs, where applicable.

With respect to purchases and other inputs, the Taxable Person should report:

- purchases and expenses that were subject to the standard rate of VAT and for which VAT is recoverable as per regulations; and

- any supplies which were subject to the reverse charge mechanism and qualify as VAT eligible for recovery

The net of the following will be the tax payable or refund from the FTA.

| Case | Result |

|---|---|

| Output VAT > Input VAT | VAT payable to the FTA |

| Output VAT < Input VAT | VAT refund or credit |

| Output VAT = Input VAT | No due tax |

What are the other terms you need to know when filing for VAT return?

To make the landscape clearer, here are a few foundational terms you’ll see often:

- Taxable supplies: goods and services you provide that fall under VAT regulations and are subject to the standard or zero rate.

- Taxable expenses: your business expenses that may be allowed for input tax recovery

Taxable Supplies: Zero-Rated vs Exempted Supplies

Taxable supplies refer to goods or services provided by a VAT-registered business that are subject to VAT under UAE law. This includes supplies charged at the standard VAT rate as well as zero-rated supplies.

Even when VAT is charged at 0%, the supply is still considered taxable and must be included in the VAT return. These zero rated supplies typically include:

- Exports of goods outside the UAE (even if export are to GCC)

- International transportation of passengers or goods

- Basic healthcare services provided by licensed professionals, such as medical treatment

- Certain educational services, including approved nursery, school, and higher education services

- Newly constructed residential buildings (first supply within a specific timeframe)

- Investment precious metals (e.g. gold, silver of qualifying purity)

In contrast, exempt supplies (or simply “non-taxable supplies”) are the ones where no VAT is charged. Input VAT cannot usually be recovered but we need to report it in the VAT return. They are different from out-of-scope activities, which fall completely outside the VAT system and are not reported as “taxable” supplies.

Example of exempt supplies:

- Granting loans or credit where income is earned through interest or margins

- Residential property leasing for long-term accommodation

- Sale of residential property after the first supply

- Sale or lease of bare, undeveloped land

- Local passenger transport within the UAE (such as taxis, buses, and metro services)

- Life insurance and reinsurance services

What’s Changing in UAE VAT From 1 January 2026 – At a Glance

The UAE VAT framework is being updated under Federal Decree-Laws No. 16 and 17 of 2025, with most changes taking effect from 1 January 2026. These amendments aim to tighten timelines, clarify procedures, and place greater emphasis on documentation and transaction verification.

For businesses filing VAT returns in 2025 and beyond, understanding what applies before and after 2026 is key to staying compliant and protecting cash flow.

Key VAT Changes: Before vs starting 2026

| Area | Before 2026 | From 1 January 2026 | Why it matters |

|---|---|---|---|

| Claiming excess input VAT / refunds | No clearly defined long-stop deadline for claiming excess recoverable VAT in practice, leading many businesses to carry forward balances for extended periods. | Excess recoverable VAT must generally be claimed or used within five years from the end of the relevant reporting period, or the right to claim may lapse. | Delayed reconciliations could now result in lost refunds if claims are not made in time. |

| Reverse charge invoicing | In some reverse-charge scenarios, businesses were required to issue self-invoices to account for VAT. | Taxable persons will no longer be required to generate self-invoices for reverse-charge transactions, provided they retain appropriate supporting documentation. This simplifies compliance. | Less paperwork, but stronger supporting documentation is still required to justify VAT treatment. |

| Input VAT recovery conditions | Input VAT could generally be recovered if invoices and basic conditions were met. | The FTA may deny input VAT recovery where transactions are linked to tax evasion and the business did not take reasonable steps to verify the transaction. | Greater focus on supplier due diligence and transaction substance. |

| VAT audits and limitation periods | Audit and assessment timelines were not always clearly aligned with refund claims and carried-forward balances. | Limitation periods for audits and assessments are more clearly defined to the last 5 years, particularly in relation to VAT refunds and excess credits. Exception to the rule: for example, where a refund claim is filed in the final year of the five-year period, the FTA can extend the audit period to complete the assessment related to that claim (typically within two years of submission) | Better certainty on how far back the FTA can review VAT positions, especially where refunds are involved. |

| Voluntary Disclosure and Limitations | Taxpayers had to use Voluntary Disclosure for many errors, even when those errors had no impact on the tax due. | You no longer need to submit a Voluntary Disclosure for every mistake. In certain cases defined by the tax authority, it will still be required—but smaller or routine errors can now be fixed directly in the tax return. | This streamlines the process, making corrections faster and simpler. |

| Administrative penalties framework | Penalties applied under earlier Cabinet Decisions, with some inconsistencies across tax types. | Updated administrative penalties framework (with some provisions effective in 2026) aligns penalties across VAT and other federal taxes. | Reinforces the importance of timely filing, accurate reporting, and proper records. |

VAT Return Deadlines in UAE: Quarterly vs Monthly

A tax period is a specific time frame for which the applicable tax and its transactions shall be calculated and paid. The standard tax period is defined as three calendar months ending on the specific date determine by the FTA.

The FTA may also, at its own discretion, assign a different tax period other than the standard one, to a certain group of taxpayers (i.e. in some business cases, business owners may be required to file tax returns on a monthly basis.)

| Filing Frequency | Who Qualifies | Deadline Example |

|---|---|---|

| A quarterly tax period covers three calendar months. You file four VAT returns per year. Quarterly filing is the default unless the FTA assigns otherwise | Most VAT-registered businesses in the UAE Small and medium enterprises (SMEs) Businesses with annual taxable turnover below AED 150 million | If your assigned quarter is: January–March → VAT return due by 28 April April–June → VAT return due by 28 July |

| A monthly tax period covers one calendar month. You file 12 VAT returns per year. | Large or high turnover businesses with annual taxable turnover exceeding AED 150 million Businesses specifically assigned to monthly filing by the FTA due to: – size of operations – transaction volume – compliance considerations | For monthly: January → VAT return due by 28 February February → VAT return due by 28 March |

IMPORTANT NOTE:

- Businesses on a standard filing period can request to shift their reporting cycle to end in a different month. This is useful for aligning VAT reporting with internal accounting periods, but the change only takes effect if the FTA approves the request. You can request using the EmaraTax Portal. This is not a general email request — it must be done through the FTA system so it’s officially recorded.

- FTA is strict with deadlines and your VAT return must be submitted to the FTA within 28 days after the end of the tax period, or on the next working day if the deadline falls on a weekend or public holiday, otherwise penalties and late payment surcharge will be imposed.

Current vs Previous Tax Period

Current tax period refers to the period you are reporting on right now. All filing must be for transactions dated during this period and must be prepared accordingly.

Sometimes, you might see instructions for “previous tax period,” which usually refers to the period that ended before the current one. The filing must already be completed and filed promptly.

For example, assuming your VAT reporting periods are quarterly, this is what filing in the second quarter will look like:

| Period | Status |

|---|---|

| Jan–Mar | Previous tax period |

| Apr–Jun | Current tax period (being filed now) |

| Jul–Sep | Next tax period |

This clarification is to make sure that you are not confused and subject to penalties due to avoidable or technical errors.

For VAT, it does not change how often you file returns, but it does affect how your tax periods are grouped and scheduled. The FTA assigns VAT-registered businesses to a stagger (different quarterly cycles) to help spread filing deadlines across the year, avoid system overload, align VAT reviews with financial reporting, and overall help create a predictable compliance cycle.

Example for Quarterly filers:

If your tax year end is 31 December, your VAT periods may look like:

- Jan–Mar

- Apr–Jun

- Jul–Sep

- Oct–Dec

If your tax year end is 31 March, your VAT periods may look like:

- Apr–Jun

- Jul–Sep

- Oct–Dec

- Jan–Mar

Step-by-Step Guide to Filing Your VAT Return

Now that the terminologies are clear, filing for a VAT return is simple using the EmaraTax portal. These are practical steps being pushed by the government – from logging in to confirming payment, they hope that this would make the process less painful for businesses to report.

Note:

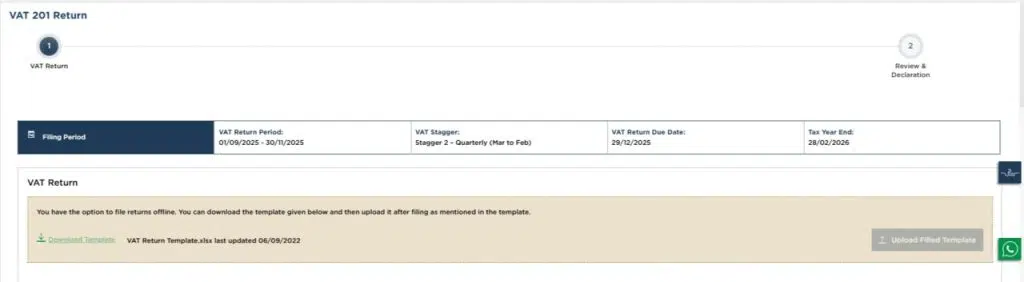

When completing the form, you must make sure to round up the numbers to two decimal places, convert the amounts to AED, and use “0” where necessary (i.e. no amounts are to be declared).

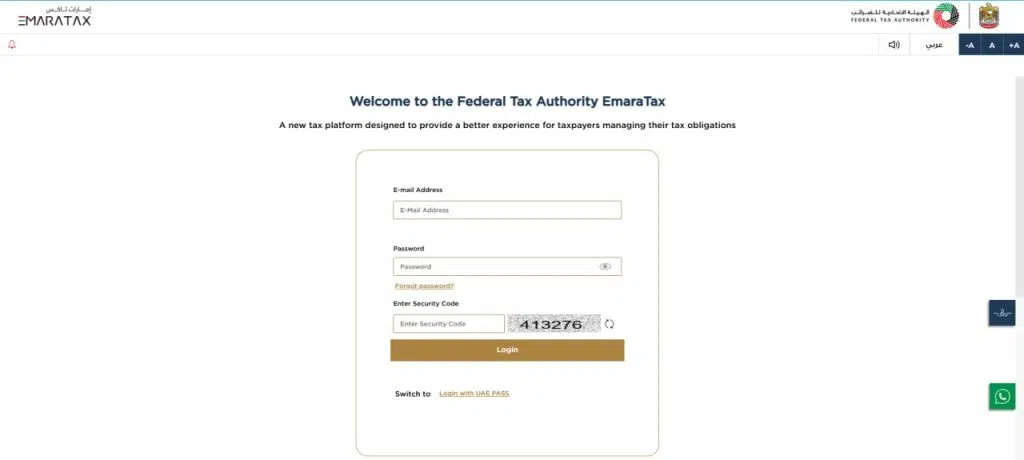

Step 1: Log into EmaraTax account using UAE Pass or email credentials.

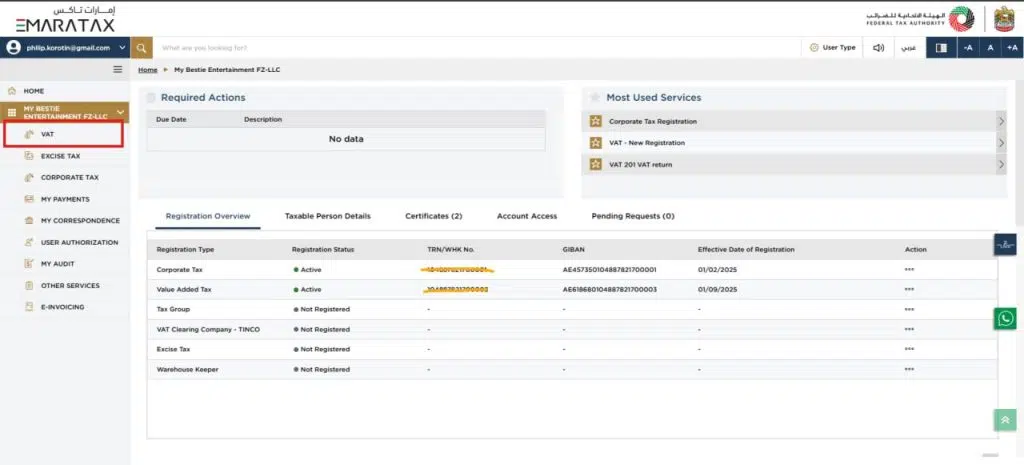

- Select the applicable Taxable Person Details.

- Business in the same tax group may file as one using their Taxable person details and must be settled by the representative handling their VAT registration.

- Similarly, a business may appoint a tax agent in their EmaraTax portal. A tax agent approval number is required to legally represent a taxpayer before the FTA and submit filings and requests on the business’s behalf

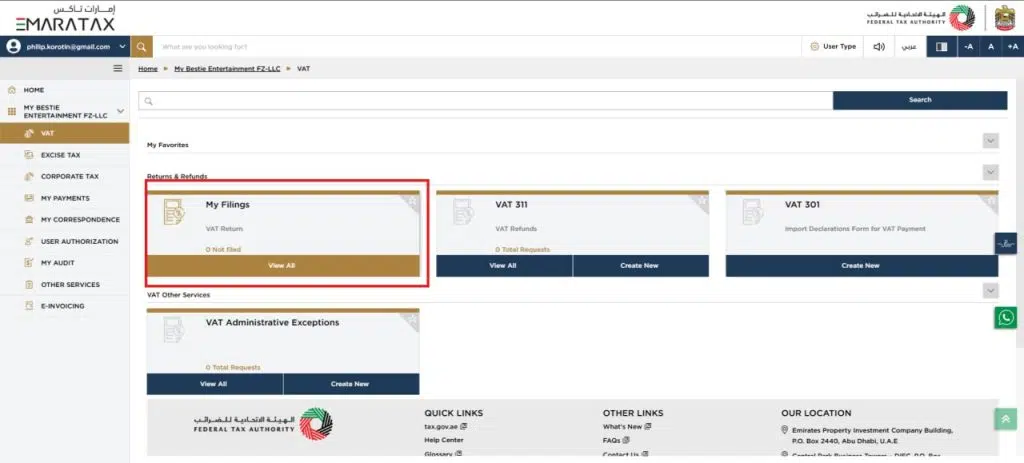

Step 2: Go to VAT → VAT 201 Return Form.

Step 3: Verify the VAT period and generate the VAT return reference period number

Step 4: Enter sales + Output VAT details

Step 5: Enter purchases + Input VAT details.

Step 6: Upload supporting documents when requested.

Profit Margin Scheme

You will be required to select “Yes” in the check box if you used and applied provisions for applicable Profit Margin Scheme goods during this period.

Step 7: Review auto-calculated payable tax /refund amount.

This is a crucial step, as most filings encounter an error at this process. Review carefully, and it is best practice to ask someone else in your team to take a third look to be sure.

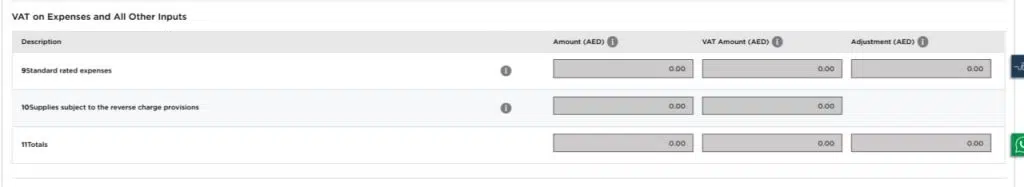

Step 8: Submit the return and submit your details as the authorized signatory.

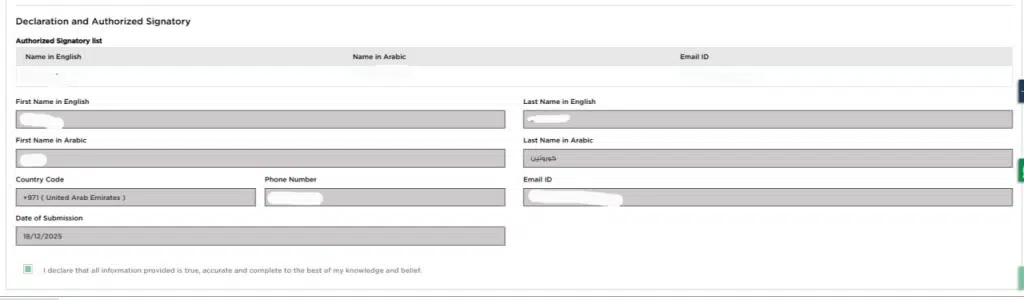

Step 9: Proceed to payment via:

- GIBAN transfer -Make sure to generate a unique payment reference number and save this for manual transfer using GIBAN.

- EmaraTax is integrated to other UAE banks and financial institutions Your GIBAN reference number is required to validate payment. If the details you provide at the time of payment are incorrect, your payment will be rejected.

- Use MagnatiPay to make online paymentseDirham has been transitioned to MagnatiPay as the new payment gateway. Payment is made flexible using any Visa or Mastercard debit or credit card. For remaining eDirham balances, you can contact your issuing bank.

Step 10: Save confirmation + acknowledgment.

Congratulations! You just finished filing your VAT returns!

For e-commerce supplies, you can refer to the following guide for details in this infographic: Emirates’ VAT return period reporting in Relation to e-Commerce supplies.

Documents Required for VAT Filing in UAE

You only need to prepare the following for the filing. People have different record keeping habits; thus, it helps to have a professional help you with keeping the business compliance ready and guide you smoothly.

- Sales invoices, purchase invoices to support VAT paid and VAT collected

- Customs import & export declarations (via Dubai Customs / UAE Customs)

- Debit / credit notes

- Tax calculation worksheets

- Expense logs

NOTE:

With tightening on input-tax claims, retain strong documentation — especially with due diligence on VAT registered suppliers — because the FTA has clearer authority to deny recoverable tax credits tied to tax-evasion risk. It helps to read more about our guide on validating and verifying VAT number here.

Common Mistakes to Avoid when you file VAT Return

In practice, VAT penalties are rarely the result of deliberate tax evasion. They are more often caused by missed deadlines, minor errors, or incomplete records.

The good news is that late filing penalties follow a clear structure and are largely preventable. With the 2026 rule changes, maintaining accurate VAT returns and transaction checks will play an even bigger role in avoiding issues.

| Common Mistake | What goes Wrong | How to Avoid it |

|---|---|---|

| Late VAT return filing | Penalty of AED 1,000 for the first offence; AED 2,000 if repeated within 24 months | Set calendar reminders, file a few days early, and confirm deadlines in EmaraTax |

| Late VAT Payment and/or Failure to pay full VAT liability | Currently at 2% + 4% monthly (maximum up to 300%) Penalty will be levied on the unpaid tax From April 2026, it will be calculated as monthly penalty of 14% per annum on the outstanding tax amount, following the due date until the date of full payment | Review the VAT payable figure carefully before submitting. Submit the return before the 28-day deadline even if payment will follow shortly |

| Incorrect VAT calculations | Under- or over-reporting VAT on sales or expenses | Reconcile invoices and totals before filing; use automated VAT calculations where possible |

| Using the wrong VAT rate | Charging or reporting VAT incorrectly (5%, 0%, or exempt) | Confirm the VAT treatment of each supply before invoicing; keep a VAT rate reference list |

| Misclassifying zero-rated vs exempt supplies | Loss of input VAT recovery or incorrect reporting | Clearly distinguish zero-rated and exempt categories; review FTA guidance when unsure |

| Poor recordkeeping | Difficulty supporting figures during audits or refund claims. In the event that a business fails to maintain the payment records, they can face AED 10,000 to AED 20,000 in fines. | Maintain organized digital records of invoices, contracts, and customs documents |

| Ignoring reverse charge requirements | VAT not accounted for on imports or specified transactions | Flag import and overseas supplier transactions for reverse-charge review |

| Missing supporting documents | Recoverable tax claims rejected or delayed | Ensure valid tax invoices and evidence are retained before claiming VAT |

| No reconciliation before submission | Discrepancies between VAT returns and accounting records | Reconcile sales, purchases, and VAT balances before submitting the return |

| Wrong VAT Return Period Reference Number VAT return period reference is the identifier for that period in the FTA system. It prevents payments or filings from being applied to the wrong period. Example Quarterly filer VAT return period: January–March 2025 Period reference: Q1 2025 (or a system-generated code tied to that quarter) Monthly filer VAT return period: July 2025 Period reference: 07/2025 | In EmaraTax, this reference is auto-generated and shown when: you file the VAT return, or you generate a payment reference (especially for GIBAN payments) Using the wrong period may result in payments being treated as unallocated or late. | Ensure your VAT payment is matched to the correct return You can also use this as reference as required when paying via GIBAN bank transfer |

What’s Changing in 2026 — A Simple Summary for 2025 Filers

With the last of this year’s reporting approaching, you must plan your 2025 reporting with these in mind:

- Five-year window for refund claims:

Excess recoverable VAT must be claimed or used within five years of the VAT return period in question — unclaimed amounts lapse. - No more self-invoicing under reverse charge in some cases:

Simplifies compliance but heightens the need for supporting evidence submitted with your VAT 201. - Anti-evasion tax conditions:

FTA can disallow input tax if a transaction is tied to evasion and you failed to verify legitimacy. - Audits & limitation periods clarified:

Audits generally capped at five years, with specific exceptions tied to refund claims detailed in the updated Tax Procedures Law.

How Skrooge Simplifies its VAT Return Filing Services

By reducing manual steps and standardizing how VAT data is prepared, Skrooge helps businesses stay compliant without relying on last-minute checks or memory-based processes. Skrooge’s AI runs as your always-on compliance pro. Together with our VAT experts, we minimize the bookkeeping service burden on your team so that you could focus on growing your business.

We believe numbers are your best decision asset; as your steady numbers partner, we help you with:

- Automated data extraction from invoices & bank feeds

- Real-time VAT calculations

- Monthly/quarterly reminders before deadlines

- Built-in compliance checks to detect errors

- Secure cloud recordkeeping

- Fast VAT 201 form preparation

Our transparent service and pricing starts at AED 1,499 for VAT return filing services. You can get started by contacting us here.

Frequently Asked Questions (FAQs)

Businesses must file quarterly, unless annual turnover exceeds AED 150 million, which requires monthly filing.

All VAT returns must be submitted within 28 days after the end of the tax period.

You can file your VAT return yourself in EmaraTax, appoint a registered tax agent, or use a professional consultant to prepare the return and then submit it yourself.

Late filing penalty: AED 1,000 (first time), AED 2,000 (within 24 months).

You need the following supporting documents for filing:

✔ Sales invoices, Purchase invoices

✔ Customs import & export declarations (via Dubai Customs / UAE Customs)

✔ Debit/credit notes

✔ Tax calculation worksheets

✔ Expense logs

You can make payment using the EmaraTax portal. The following options are available.

-> GIBAN transfer – Make sure to generate a unique payment reference number and save this for manual transfer using GIBAN.

-> Use MagnatiPay to make online payments

eDirham has been transitioned to MagnatiPay as the new payment gateway. It accepts payments made using any Visa or Mastercard prepaid, debit or credit card. For remaining eDirham balances, you can contact your issuing bank.

Output VAT: VAT collected on sales.

Input VAT: VAT paid on purchases; can be reclaimed if eligible.

The difference will define if you have to pay VAT to the FTA or are eligible for VAT refunds. Both will need to be disclosed in your VAT 201.

The impact of your mistake depends on type and size of the mistake

1. For Minor or non-material errors -> may be corrected in a subsequent VAT return, if allowed

2. For Material errors or errors affecting net VAT payable /refundable -> Required to file a Voluntary Disclosure (VAT211)

Possible consequences include 1) Additional payable tax (if VAT was underreported); 2) delay or reduction in VAT refunds; 3) Administrative penalties, depending on severity and timing

In the 2026 amendment update, voluntary Disclosure is no longer mandatory for all errors. The FTA may specify which cases require disclosure and some errors can now be corrected directly through the VAT return

Yes — if your total recoverable tax is greater than your sales tax for the specific VAT period, you can claim the difference back from the FTA. You will be required to file your VAT return first. Once your return reflects an excess of input tax over output tax, you can proceed with a refund application using Form VAT 311 on EmaraTax portal.

Zero-rated supplies: Taxable at 0% (you can recover tax)

Example:

Exports of goods outside the UAE (including GCC, subject to conditions)

International transportation of passengers or goods (subject to conditions)

Certain healthcare services, such as basic medical treatment

Certain educational services, including approved nursery, school, and higher education services

Newly constructed residential buildings (first supply within a specific timeframe)

Investment precious metals (e.g. gold, silver of qualifying purity)

Exempt supplies: No VAT charged (you cannot recover tax)

Example:

Granting loans or credit where income is earned through interest or margins

Residential property leasing for long-term accommodation

Sale of residential property after the first supply

Sale or lease of bare, undeveloped land

Local passenger transport within the UAE (such as taxis, buses, and metro services)

Life insurance and reinsurance services

Yes. You must file a Nil VAT Return if you are VAT registered.

EmaraTax is the UAE FTA’s official online tax platform, helping taxpayers register, file returns, pay taxes, and manage obligations easily in one place.

Thank you!

We've received your request and will get back to you shortly.