Businesses need to complete value added tax (VAT) registration when their turnover crosses AED 375,000. You can also voluntarily register for VAT if you want to recover input VAT.

However, once you register for VAT, you must file returns every quarter, or every month for businesses with more than AED 150 million in turnover.

So, if your business has transitioned to dealing solely in exempt supplies or no longer meets the annual turnover threshold, the VAT filing requirements will place unnecessary compliance-related strain on your business. If you have downsized, these filing obligations may also expose you to VAT penalties.

For such businesses, we have compiled this guide, which will help you understand the VAT deregistration process and reduce your compliance burden and exposure to penalties.

UAE VAT Deregistration

The Federal Tax Authority (FTA) allows, or in some cases requires, businesses to complete VAT deregistration when:

- You are no longer make zero-rated or standard-rated supplies

- You are below the voluntary (or sometimes mandatory) registration threshold

In specific cases, VAT deregistration for other reasons may also be allowed.

You can submit a VAT deregistration application at any time through the EmaraTax platform free of charge. If your application is approved, you will receive a Deregistration Certificate. Typically, the FTA takes 20 business days to process VAT deregistration applications.

Tip

Even if your deregistration is pre-approved, you still need to file your final VAT return within 28 days of the pre-approval date. So, to avoid delays or penalties, you must continue VAT filing preparations in parallel to your deregistration application.

When Should a Business Deregister from VAT? (Eligibility & Conditions)

Here, we discuss the 4 cases wherein VAT deregistration is possible.

1. Cessation of taxable supplies – Mandatory VAT Deregistration

Taxable supplies are goods and services that attract a value added tax (VAT), which is either 0% (zero-rated supplies) or 5% (standard-rated supplies). If you only dealt in exempt supplies, you wouldn’t have needed to register for VAT. Exempt supplies do not attract any VAT, not even 0%.

If you transition to being an exempt supplies-only business, you must apply for VAT deregistration within 20 business days.

2. Turnover less than voluntary registration threshold – Mandatory VAT Deregistration

The voluntary VAT registration threshold is AED 187,500. If your turnover falls below this threshold in 12 consecutive months, you must apply for VAT deregistration within 20 business days. So, if your turnover falls below AED 187,500 in the 12 months from 1st January 2025 to 31st December 2025, you must apply for VAT deregistration by 29th January 2026.

3. Turnover less than mandatory registration threshold – Voluntary VAT deregistration

The mandatory VAT registration threshold is AED 375,000. If your turnover in the previous 12 months falls below this threshold and at least 12 months have passed since you voluntarily registered, you can apply for voluntary deregistration.

4. Multiple TRNs or branch registration – Mandatory VAT deregistration

You cannot have VAT tax registration numbers (TRNs) for branches or multiple TRNs for the same entity. If you made this error, you must apply for deregistration. Ensure that you select ‘Other’ as the reason in your application.

The VAT Deregistration Application Process in UAE

Now, let’s discuss the VAT deregistration process in detail.

Step 1: Log in to EmaraTax portal

You can log in to EmaraTax via your registered email ID or your UAE PASS. If you try to register using your registered email and you have opted for 2-factor authentication, you will need to submit the OTP received on your registered email ID.

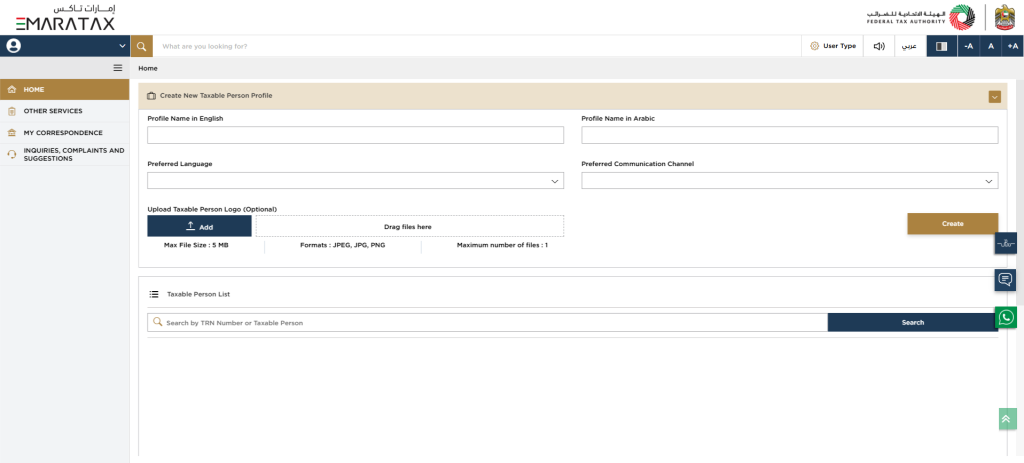

Step 2: Select taxable person

Once you log in to EmaraTax, you will see a taxable person list. When you find the taxable person you want to deregister, click the ‘View’ button under their name.

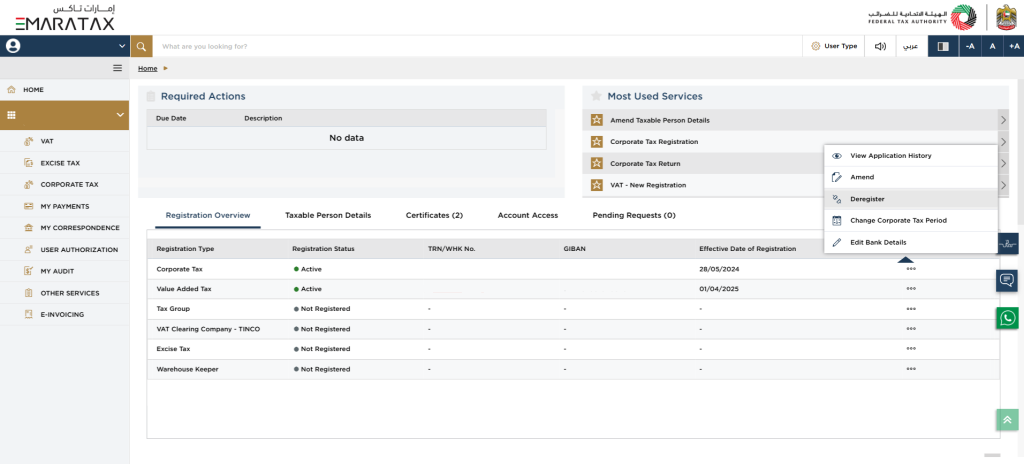

Step 3: Initiate deregistration

Find the ‘VAT’ tile in the ‘Overview’ section, click on ‘Actions’, and then click ‘Deregister’. Before you can proceed with your application, you will see a dialog box that gives you the option to edit or review your bank details. If you do not need to edit/review these details, simply click ‘Proceed to De-Registration’.

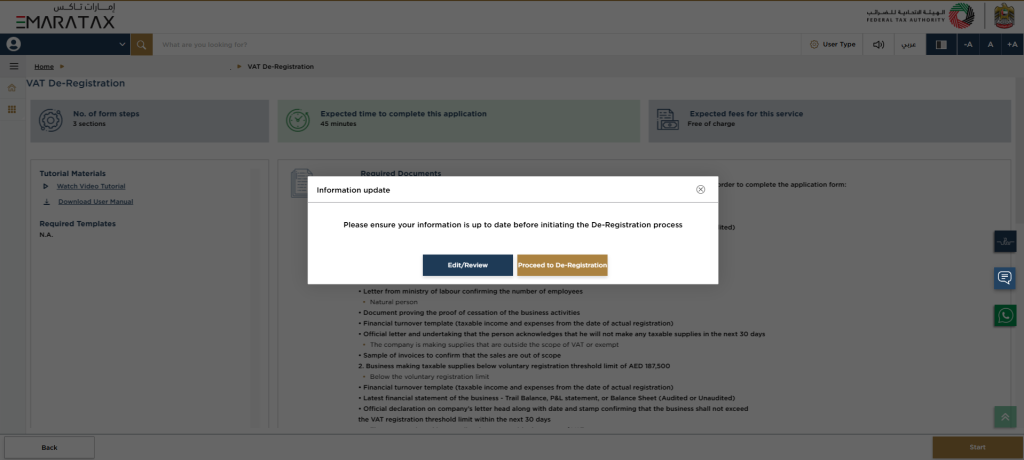

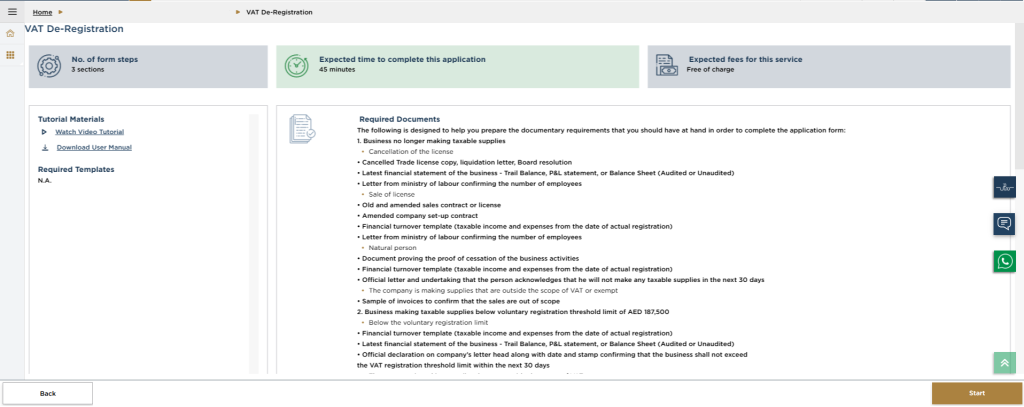

Step 4: Review latest guidelines and instructions

When you click ‘Proceed to De-Registration’, an information page containing the latest guidelines and required documents will open. Go through this page carefully.

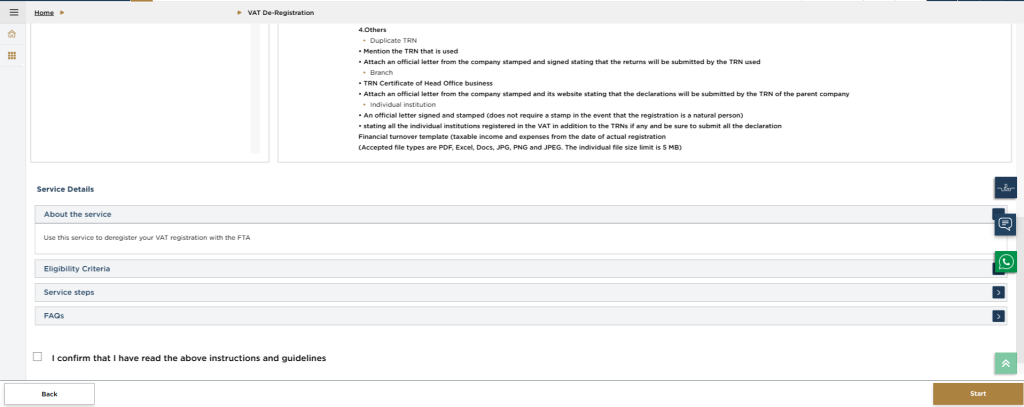

Once you are confident that you want to continue with deregistration and that you have all the required documents, scroll to the end, check the box to confirm that you have read all the information, and click ‘Start’ in the bottom right corner.

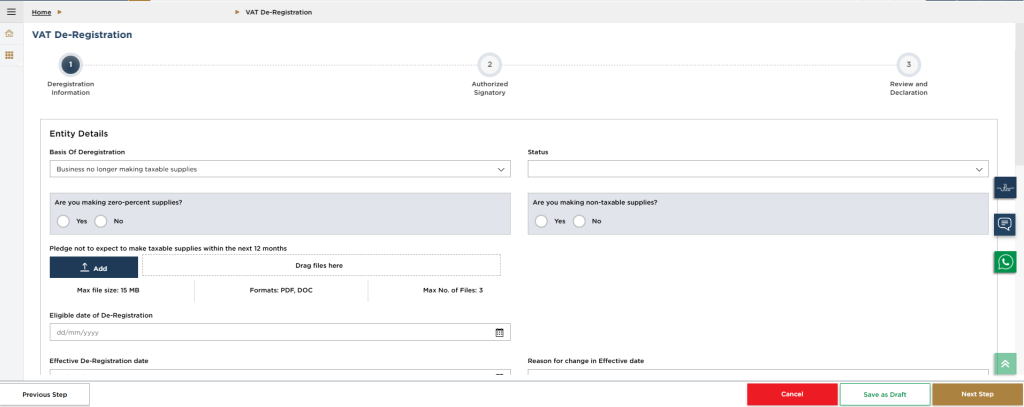

Step 5: Fill deregistration form

Your VAT details will be pre-filled in the deregistration form. You will first need to select the basis of your deregistration, based on which, the form structure will be updated. This choice will also influence the documents required to be uploaded.

Generally, you first need to select the date of eligible/mandatory VAT deregistration and the effective deregistration date.

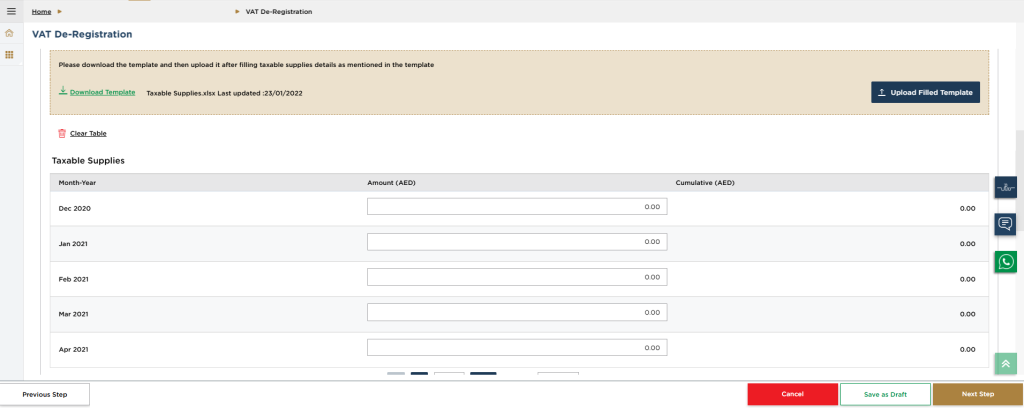

Then, you must submit your taxable supplies and expenses by manually filling the form or by uploading a spreadsheet (XLSX format) based on the downloadable template. All figures in this section must be in AED.

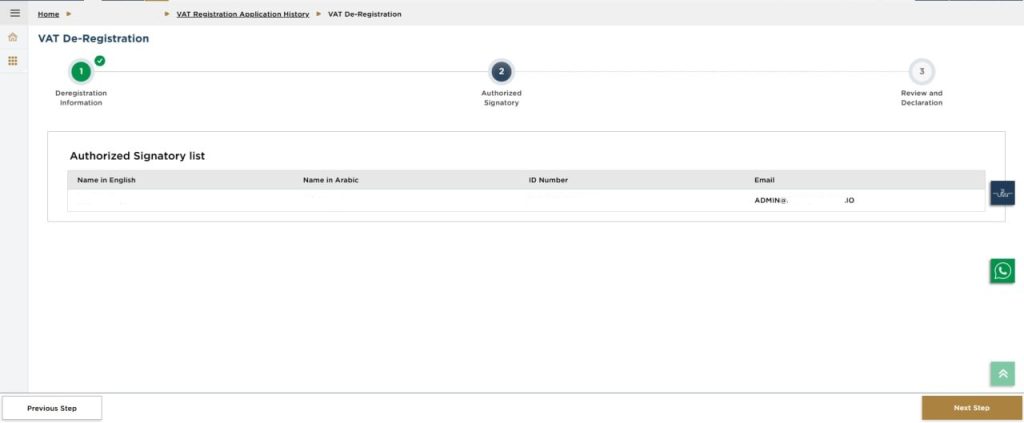

Then, you can move on to the ‘Authorized signatory’ section by clicking next. Check the authorized signatory details (name in English and Arabic, and email ID) and click next if you are satisfied.

Step 6: Review and submit

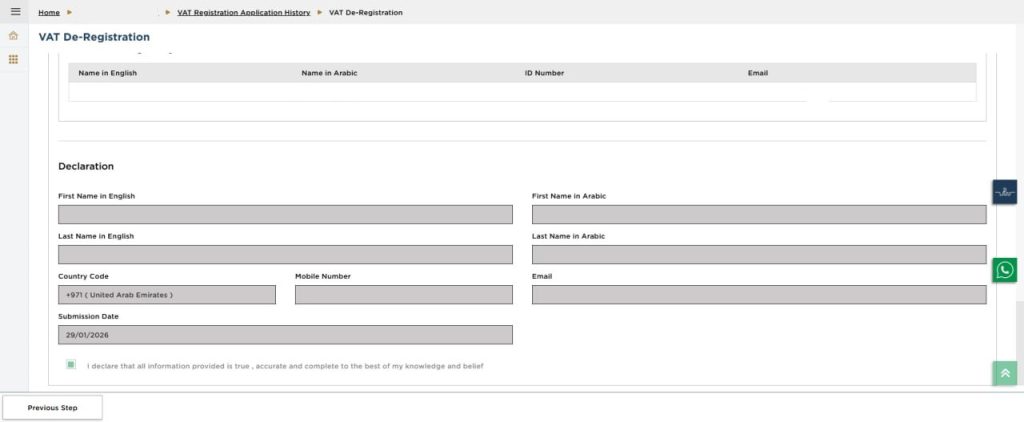

Carefully review the deregistration application details, and once you are satisfied, select the checkbox to declare that you have read and verified all information. Then, click ‘Submit’.

If any unaddressed form messages exist, a dialog box will open to confirm if you wish to submit anyway. Click ‘Yes’ to submit your application.

Note down the application reference number as well as any key information that appears on screen.

Required Documents for VAT Deregistration

The following guide will help you understand which documents are needed for VAT deregistration based on your reason for deregistration.

- No Longer Making Taxable Supplies

- License Cancellation

If your trade license has been cancelled, you will need:- Copy of cancelled trade license

- Liquidation report

- Board resolution

- Latest financial statements

- Letter from MoHRE confirming the number of employees

- License Sale or Transfer

If you have sold your business or transferred ownership, submit:- Old as well as new sales contracts or licenses

- New company setup contract

- Financial turnover template

- Letter from MoHRE confirming the number of employees

- Natural Person Ceasing Taxable Business Activities

If you are an individual who has stopped taxable activities, provide:- Proof of cessation of business activities

- Financial turnover template

- Official letter and undertaking stating that they will not make taxable supplies in the next 30 days

- Transition to Exempt/Out-of-Scope Supplies

If your business now makes only exempt/out-of-scope supplies, you must submit:- Financial turnover template outlining the taxable income and expenses since the date of actual registration

- Latest audited or unaudited financial statements, comprising balance sheet, profit and loss statement, and trail balance

- Official letter (signed and sealed) acknowledging absence of business within the UAE (Only for out-of-scope supplies)

- Chart showing business itinerary, suppliers, and importers, as well as countries of customers and suppliers (Only for out-of-scope supplies)

- Sample invoices (Only for out-of-scope supplies)

- License Cancellation

- Turnover Below Voluntary Registration Threshold

If your annual turnover has fallen below AED 187,500, provide:- Financial turnover template

- Latest financial statement

- Official letter and undertaking

- Turnover Between Voluntary and Mandatory Registration Thresholds

If your turnover sits between AED 187,500 and AED 375,000, submit:- Financial turnover template

- Official letter with date and stamp stating that your business will not exceed the VAT registration threshold within the next 30 days

- Other Deregistration Scenarios

- Duplicate TRN

If you were issued a duplicate Tax Registration Number, provide:- The TRN you are currently using

- Official letter and declaration

- Branch Was Registered Separately

If a branch was registered independently but should fall under the head office, attach:- TRN Certificate of the head office

- Official letter and declaration

- Individual Institution Consolidation

If you need to consolidate multiple individual institution registrations, submit:- Financial turnover template

- Official letter and declaration

- Duplicate TRN

Note

- Each required document must be uploaded as PDF, Excel, Docs, JPG, PNG, or JPEG (whichever is appropriate), and the individual file sizes should not be more than 5 MB.

- All official letters must be on the company letterhead with date and stamp unless otherwise specified.

- The FTA may request additional documents during the review process, depending on your specific circumstances.

- Official letter format varies case by case.

Timeline and Penalties for VAT Deregistration in the UAE

When you are deregistering from the UAE’s VAT framework, you must be mindful of two key violations.

Late VAT deregistration

If you are required to mandatorily deregister from the VAT framework, you have only 20 business days to do so. Once these 20 business days have elapsed, an administrative penalty of AED 1,000 will apply. Then, for each successive month in which deregistration is delayed, additional penalties of up to AED 10,000 will apply.

Late filing of final VAT returns

Within 28 days of the date of pre-approval, you must file your final VAT return. Otherwise, you will not only face penalties, but there’s also a chance of your application being delayed.

Post VAT Deregistration Process

Just because your deregistration application is preapproved doesn’t mean the process is complete. You still need to file your final VAT return. If your account has outstanding VAT liabilities and penalties, you will need to settle them so that your deregistration is confirmed.

On the other hand, if any refunds are pending, you will need to initiate the refund process on the EmaraTax portal. That’s one thing you can potentially look forward to.

Once the final dues/refunds are processed and the final VAT return is filed without errors, your deregistration may be finalized by the FTA.

Important

For future tax compliance purposes, retaining VAT records of at least 5 years is a good idea.

VAT Deregistration Consultants

The official FTA guides state that VAT deregistration can be completed within 45 minutes. However, that is a gross underestimation if you consider the time required to ensure that all required documents are compiled and all form details, including the calculation of taxable supplies and expenses, are accurate.

That’s where professional VAT deregistration consultants, like Skrooge, come in. As your tax advisor, in the first consultation itself, our team will provide you with a comprehensive checklist of all the information and documents needed so we can get started immediately. Once the application is submitted, we will oversee the entire workflow until the final VAT return filing and processing of final dues.

We are not offering simple form-filling services. Instead, we offer end-to-end compliance!

Contact us to know more!

FAQ

Late VAT deregistration penalties (more than 20 business days since deregistration trigger) apply only for mandatory VAT deregistration and not for voluntary VAT deregistration. Also, mandatory deregistration is needed when your transition to dealing solely in exempt supplies, your turnover drops below the voluntary registration threshold, or you have mistakenly registered a branch instead of the parent company. On the other hand, voluntary deregistration is typically possible only when your turnover is between the mandatory and voluntary registration thresholds.

The entire VAT deregistration process, from application to final approval, can take more than 20 business days. After you file the final VAT return and process the pending VAT-related dues, the FTA will consider your application and deregister you within the next 20 business days.

Late VAT deregistration attracts a penalty of AED 1,000 and then additional penalties of up to AED 10,000 for every subsequent month in which deregistration is delayed.

Yes, it is possible and, if your taxable supplies exceed AED 375,000 again, necessary to re-register for VAT after deregistration.

Yes, filing a final VAT return within 28 days of the VAT deregistration pre-approval date is a key step for finalizing your deregistration.

If your deregistration application was rejected because of incorrect details or incomplete documents, you may need to reapply. In case of voluntary deregistration application rejections, there might not be a recourse.

You should retain any VAT-related records for at least 5 years in case of any future audits or in case you need to re-register.

The VAT deregistration process is almost deceptive long and occurs in phases, so businesses can benefit from professional VAT deregistration consultants like Skrooge.

Thank you!

We've received your request and will get back to you shortly.