Trying to keep up with the Federal Tax Authority (FTA) rules, chase invoices, and still avoid tax liabilities and penalties can be frustrating and difficult to navigate. Since the government introduced Federal Decree Law No. 8 of 2017 on Value Added Tax (VAT), which took effect on 1st of January, 2018, business owners have faced the challenge of staying compliant with the evolving rules and filing deadlines. With new penalties being introduced under Cabinet Decision No. 129 of 2025 issued 9 Oct 2025 and effective from 14 April 2026, VAT compliance has become more complex and complicated.

While in-house tax teams can be expensive, relying solely on external firms with different functions often leads to fragmented workflows that require constant coordination across departments. A hybrid model that balances automation for efficiency and experts for judgment delivers a more seamless, accurate, and audit-ready VAT process.

This more innovation-centric approach used for professional services can simplify the process, reduce risks, and keep your business audit-ready according to UAE tax laws. Whether you’re registering for the first time, filing quarterly returns, or reviewing your tax savings and VAT compliance, working with professional VAT consultancy services in Dubai ensures accuracy, transparency and peace of mind.

What do professional tax advisory services do for businesses in the UAE?

In a fast-moving market like the UAE, businesses need more than basic financial and accounting services. Leading VAT consultants in UAE and other tax advisory service firms need to step in with their knowledge of UAE VAT law and regulations. Breaking this down into real case scenarios, business can expect help on:

- VAT registration and compliance support – ensures you meet the threshold and deadlines for compliance (for instance, the UAE has mandatory and voluntary VAT registrations threshold, depending on turnover) and file tax returns on a timely manner.

- Ongoing advisory – VAT advisory focuses on the VAT implications of different types of transactions. This includes classification of supplies (standard rated, zero-rated, exempt, out of scope), treatment of cross-border and free zone activities, and input VAT recovery on different types of costs. Proper advice helps businesses avoid incorrect zero-rating or exemption, manage non-deductible expenses, and maintain VAT compliance documentation if the tax authority reviews their records.

- Audit Readiness, assurance services and early problem solving – if regulators raise questions, professional tax consultants can step in and address concerns with documentation, answer queries and sort out issues before it becomes penalties . In other words, hired consultants will ensure that your documents are always audit-ready during their period of service.

Engaging tax advisory services can turn a consistent headache into a more manageable function, keeping compliance automatic and fixing issues before they snowball. Ultimately, good consultants can become your strongest allies in being more strategic with growth.

Quick Recap on Taxation Guidelines

1. Voluntary vs Mandatory registration

According to UAE Vat law, a business is required to register for VAT under mandatory registration if their taxable supplies (both standard rated and zero-rated) and imports exceed threshold of AED 375,000 within the past 12 months, or are expected to pass the threshold in the foreseeable future. Deadline to file the mandatory registration is within 30 days from the date of crossing the threshold.

A business may otherwise opt for voluntary registration if their taxable supplies and imports are more than AED to 187,500 up to AED 375,000. Registering for VAT voluntarily benefits them with the ability to claim input VAT early. This is especially applicable for companies with significant taxable expenses (even pre-revenue startups) to recover input VAT. Additionally, for imports, this allows business owners to use the reverse charge mechanism (RCM), which is cash-neutral vs paying cash VAT at the borders.

While UAE VAT registration normally follows the AED 375,000 mandatory and AED 187,500 voluntary thresholds, several exceptions apply.

- For non-resident businesses supplying taxable goods or services in the UAE (and where no UAE-based party accounts for VAT), VAT registration is mandatory from their first taxable supply — there is no minimum turnover threshold.

- Meanwhile, businesses dealing solely in VAT-exempt supplies are generally not required to register, and imports or expected large contracts can trigger registration earlier than anticipated.

2. VAT responsibilities:

All UAE businesses must keep accurate, up-to-date financial records. Even if you’re not yet required to register for VAT, you must maintain records to determine when registration becomes necessary. VAT-registered businesses must file regular monthly/quarterly returns, reporting VAT collected versus VAT paid. If you collect more than you pay, you remit the difference; if you pay more, you can reclaim the excess or adjust against future payables.

3. Certain goods and services may qualify for either a 0% VAT rate or full exemption, provided they meet the required conditions.

Here’s a simple breakdown:

| Category | VAT Rate | Examples |

|---|---|---|

| Standard-rated | 5% | Most goods and services |

| Zero-rated | 0% | Exports, education, healthcare, international transport |

| VAT Exempt | N/A | Residential rent, local transport, certain financial services |

- For services in Dubai, Cabinet Decision No. 46 of 2020 clarifies what it actually means to be “outside the state.” A customer can still fall under zero-rating even if they set foot in the UAE as long as their stay is short (under one month) and their presence isn’t connected to the service being provided. It’s a nuance many businesses miss.

- Some areas are fully VAT-exempt, especially certain financial services and the ongoing supply of residential property. The VAT treatment of real estate follows a simple rule of thumb:

- Commercial properties → always taxed at 5%

- Residential properties → generally exempt except first supply

4. VAT Rules on Free Zones

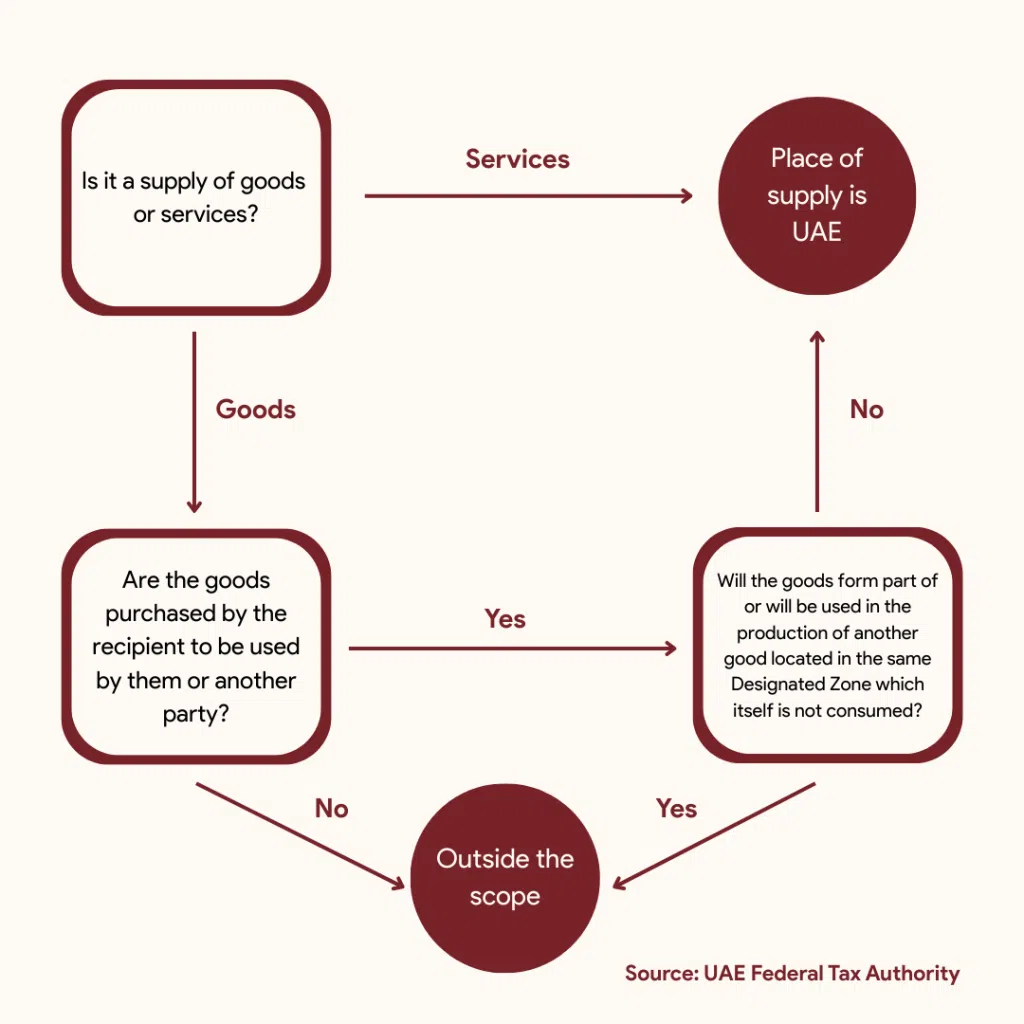

Designated Zones (DZs), or otherwise known as only specific zones approved by Cabinet decision, have special treatment for goods. Certain transactions of goods between companies in these zones may fall outside the scope of VAT. However, it’s important to note: services supplied within Designated Zones are still subject to VAT under standard UAE rules. The flowchart below breaks down how to figure out where the place of supply really occurs for goods and services in a Designated Zone.

Photo: Is your business applicable within the Designated Zone? (Source: Tax.gov.ae)

Read more on Value Added Tax from the government’s website. More information is also available Federal Tax Authority website.

Best VAT Consultancy Services in Dubai: Why Businesses Choose skrooge.ai for their AI-Powered VAT Compliance Solutions

AI-powered VAT tracking systems are reshaping how tax advisory firms work in the UAE. Automation could now handle high-volume tasks including collecting documents from ERPs and accounting systems, parsing and categorizing invoices, running compliance checks, and tracking VAT deadlines. Machine-learning tools can flag missing TRNs, misclassified supplies, or unusual input tax claims, while human advisors review cases that require judgment.

This shift aligns with the UAE Federal Tax Authority’s own digital push, including AI-driven compliance tools and upcoming e-invoicing requirements that support real-time verification. Using the same tech direction, VAT consultants deliver faster filings, fewer errors, and more proactive tax planning.

As a result of this new age of technology, a modern breed of tax consultants must ensure efficient tax planning by blending automation and human expertise. Compared to traditional firms who rely on manual review, and other tech startups who end up over-automating, Skrooge’s “human + automation” model is a middle ground that follows transparent pricing, UAE-focused expertise and more efficient feedback loops.

Through this blended approach, Skrooge ensures that every filing is made smarter and more efficient. As businesses grow to higher volume, and therefore, need faster feedback, Skrooge’s VAT consultants can help companies stay compliant, save time, and gain real time visibility into their numbers.

From registration to return filing, every step is powered by automation for speed and accuracy, and reviewed by professional accountants for reliability with no hidden fees. Skrooge is an experienced service firm of accounting consultants using technology, providing tailored solutions for filing in accordance to tax laws, financial management and bookkeeping services.

Comprehensive VAT Services by UAE VAT Consultants

VAT taxes in the UAE are different from sales taxes. While both are considered consumption taxes, the sales tax is typically charged only at the final point of sale and usually applies only to goods.

VAT, on the other hand, is an indirect tax which applies to goods and services at every stage of the supply chain from importation, to production, distribution, and all the way to the final sale. Simply put -because VAT is charged at every step, it is easier to account for the tax more accurately. VAT is therefore tracked to avoid misreporting taxes, and this creates a fair playing field for domestic businesses and imported goods and services.

The UAE additionally imposes an Excise Tax, first rolled out nationwide in 2017. This is an indirect tax that targets products viewed as harmful to public health or the environment. These “excise goods” fall into specific categories, which currently include:

- Tobacco and related tobacco-based items

- Liquids intended for use in electronic smoking devices and similar equipment

- Electronic smoking devices and similar equipment

- Carbonated and other energy beverages (with the exception of plain sparkling water)

- Sweetened beverages

Because of this complexity, UAE businesses rely on end-to-end VAT consultancy services that cover every stage of their obligations: registration, ongoing return filing, advisory, and audit support or representation when the FTA reviews their transactions.

Beyond filings, VAT consultants can provide strategic planning. The scope includes structuring operations between the mainland and free zones, planning for cross-border transactions, or preparing documentation for potential refunds. When the FTA initiates a review or audit, audit support services help firms respond quickly, supply required evidence, and resolve discrepancies with minimal disruption.

| Service | Who Needs It | Outcome | Typical Timeline |

| VAT Registration (including initial threshold check, TRN issuance) | New businesses, startups, foreign-established entities making supplies/ imports into UAE | TRN issued, legal registration completed, avoids late-registration penalties | 20 business days (subject to documentation) |

| VAT Accounting, Return & Compliance Package (quarterly/ monthly filings, input/ output reconciliation, calculating VAT) | All businesses with ongoing VAT-liability or input tax to reclaim | Accurate filings, reduced risk of fines, smoother cash-flow through input tax recovery | Ongoing (per tax period) |

| VAT Management, Advisory & Planning (business structure review, free-zone vs mainland, export/ import strategy) | Growing businesses, multi-emirate or cross-border operations | Strategic tax posture, optimization of VAT position, fewer surprises in audits | Project basis (4-8 weeks typical) |

| Audit Support and Representation | Businesses flagged by FTA, or wanting proactive review (‘health check’) | Rapid reaction capability, documentation in place, lower risk of penalties | One-off or annual review (takes typically 2-6 weeks) |

VAT Registration Process in the UAE — Step-by-Step

The whole process typically takes 20 business days (or 2 to 3 working weeks) from creating your account to receiving your Tax Registration Number. This number is what you’ll use to charge, report, and pay VAT. You can also link your TRN to your email address for easier account access.

- Sign-up for an EmaraTax account through the FTA’s website and activate your account.

- Access the EmaraTax account dashboard

- Create New Taxable Person Profile

- Click on “View” to access the Taxable Person Account

- Click on “Register” under “Value Added Tax”

- After completing the registration form, you can now submit your application for review. The FTA will then evaluate it and either approve it, reject it, or request further details. If additional documentation or clarification is needed, you will receive an email specifying exactly what must be provided.

- Once the FTA has accepted your application, you will be informed of the outcome by the status on your dashboard. This will be updated directly to reflect the decision. You can monitor the progress of your application through the dashboard at any time. Note that the FTA will not call or text you about your application, so be careful!

- Lastly, you can now receive your TRN (Tax Registration Number).

NOTE:

You could check our full guide VAT Registration Requirements & Process: Beginner-Friendly Guide for more information. Remember that before you submit, double check that each scanned document (PDF or DOC) is under 15 MB and has clear text.

Other source: FTA VAT registration requirements

What are the common rejection reasons for VAT registration?

If the FTA raises any of the points discussed below, they will typically request additional information rather than reject the registration. The FTA only rejects an application if they determine that the supplies are out of scope.

1. Ensure relevant fields are typed correctly.

Mismatched legal names, trade license documents, or other typos in the registration application may lead to your application being rejected by FTA.

2. Submit all the necessary documents and prepare them ahead of time

Incorrect documents or evidence of business owners may lead to disapproval of your application.

3. Ensure that your account details are accurate, can receive payments electronically, and submitted in time for refunds processing

Technically, bank details are optional at the time of VAT Registration. You may also provide or update the bank account details after the VAT registration is completed. If your account is held with a bank established in the UAE or a foreign bank account, the account name must match the legal name of the entity you are registering with the FTA.

List of documents required for VAT registration in UAE

To ensure a smooth approval process from the Federal Tax Authority and reduce any future headaches, make sure to carefully prepare your important documents for VAT registration. This is very important because, in our experience, incorrect or incomplete paperwork is one of the biggest reasons for delays or rejections.

VAT Compliance, Filing & Applying for Tax Savings in Dubai

| Category | Details |

| Tax Periods | • Quarterly (default for most businesses) • Monthly (large-turnover businesses) |

| Return Filing Deadline | 28th day of the month following the end of the tax period. If the due date falls on a weekend or public holiday, the deadline shifts to the next working day |

| Payment Obligations | • Output VAT – Input VAT = Amount payable • Payment must be made on or before the 28th-day deadline • Return must be filed even if no payment is due |

| Late Filing Penalties | • AED 1,000 for first late filing • AED 2,000 if repeated within 24 months |

| Late Payment Penalties | From now until 13 April 2026: • 2% of unpaid tax obligations immediately after deadline • Additional 4% if unpaid for every month it is not settled • Further daily penalty may apply (varies by rule cycle) • Penalties may reach up to 300% in severe cases However, under Cabinet Decision 129 of 2025 and effective from 14 April 2026: The new regime is now a flat penalty of 14% per annum, calculated and accrued monthly on outstanding unpaid tax |

| Other VAT Penalties | • Late registration: AED 10,000 made after 30 days of exceeding the threshold • Failure to issue a proper tax invoice : AED 2,500 per missing invoice • Failure to inform the Authority of any circumstance that requires the amendment of the information pertaining to its Tax record: AED 5,000 for the first time and AED 10,000 in case of repetition Cabinet Decision 129 of 2025 will further reduce this from 14 April 2026 to AED 1,000 for first time and AED 5,000 in case of repetition • Under UAE Commercial Companies Law, filing to keep accounting records as required can result in a fine between AED 50,000 and AED 500,000. Additionally, not keeping the records for the required five-year period can lead to an additional fine between AED 20,000 and AED 100,000. |

| Important Notes | • Returns + payments must both be submitted to avoid penalties |

More information on the penalties can be found in the Federal Tax Authority website.

How to claim refunds under FTA scheme: Process guide

For companies expecting refunds, VAT specialists can manage the full refund process, ensuring evidence is complete and reconciled, and the business remains compliant to prevent delays. These services are especially valuable in sectors with higher VAT complexity (such as logistics, healthcare, real estate, F&B, and education) where one error can impact cash flow or VAT credit recovery.

You can claim your refunds in a number of circumstances.

Simplified Steps for claiming your VAT refund

- To file a refund request, you need to log in to the FTA e-Services Portal with your credentials. Next, navigate the portal to the VAT tab/section, open VAT Refunds, and select VAT Refund Request under the relevant box (ie Request VAT Refund box) to access the application form.

- You will need to attach a bank account validation letter or certificate issued and stamped by your bank. This document must show the account holder’s name consistent with the name as registered with the FTA, along with the bank’s name, address, SWIFT/BIC code, and IBAN. This bank validation letter or certificate is a mandatory requirement for processing your refund.

- After your Refund Form is submitted, the FTA will review within 20 business days and notify you by email. If the refund is approved, the payment is typically released within 5 business days. The FTA can extend the review timeline and will let you know if additional time is required.For applicants using an international bank, the refund may take longer than 5 business days to reach your account, and any transfer fees charged by your bank will apply.

The steps above apply to VAT-registered businesses claiming a refund of excess input VAT through the FTA portal. For other refund schemes (tourists, foreign businesses, etc.) you could check Federal Tax Authority website.

Specialized VAT Services & Industry Expertise of VAT Consultants in Dubai

VAT regulations in the UAE may vary between mainland and Free Zone businesses, and further context may be needed depending on the sub sector industry. It is crucial to find sector-specific expertise from consultants who understand the difference between standard VAT treatment for mainland entities and Free Zone rules for movement of goods, including the zero-rating and import/export flows for Designated Zones. An experienced VAT consultant will help business owners avoid common pitfalls that trigger FTA scrutiny and penalties.

A common example include F&B businesses, often struggling with mixed supplies and tricky deductible VAT recovery. E-commerce businesses, due to their fast moving nature, must navigate cross-border sales, platform fees and high-volume tax reconciliations.

Similarly, logistics companies face cross border challenges as they handle complex import/export documentation and reverse charge on services; healthcare and education services must rely on correct exemption or zero-rating; and real estate companies need to distinguish between commercial, residential, and first-supply rules. In practice, the consultant’s sector knowledge is what saves you when it prevents expensive errors most people don’t see coming.

Beyond standard bookkeeping and accounting services, specialized VAT service providers are able to go beyond routine filings, and focus on protecting your business needs from unnecessary risk. For example, you need an expert that can do a “health check” and review past returns, invoices, zero-rated and exempt claims; they must be able to spot issues through mock audits. A good consultant will be able to simulate authority checks so that businesses can correct gaps like missing documentation, misclassified supplies or overstated VAT credits, early or otherwise, completely prevent them from happening.

How much is the pricing for VAT Consultants and what are possible cost effective solutions?

VAT consulting fees in the UAE can widely vary based on the scope of work, the firm’s inhouse expertise, and whether the engagement includes ongoing support or one-off tasks. Many traditional firms charge separately for each step including registration, return filing, advisory hours, corrections, and audit support, which often leads to unpredictable costs.

A more cost-effective approach is to work with a VAT consultant that offers transparent, bundled pricing. This ensures businesses know exactly what they’re paying for, reduces surprise add-ons, and gives founders confidence that compliance is covered month to month. Below is a sample comparison of typical market structures for VAT advisory services.

| Package | Inclusions | Approximate Pricing |

|---|---|---|

| Starter | VAT registration support (TRN application), initial threshold assessment, limited financial transactions, basic compliance check, email support, basic VAT advisory services | VAT registration advisory: ~AED 1,000 for consultant fees and Lite filing / micro packages for VAT returns quarterly roughly 300 – 800 per quarter (≈100–270/month) and for very small volumes (i.e. up to 25 invoices monthly) |

| Standard | Quarterly VAT return filing, VAT reconciliation, document review, VAT strategy and basic advisory | Retainer bundles can be between ~AED 1,000 – 3,500 per month for SMEs depending on volume and add-on |

| Advanced | Monthly VAT filing, high-volume transaction processing, reverse charge validation, refund claim preparation, mock audit review, priority support, virtual CFO services, strategic planning | AED 2,000 – 6,000 per month (depending on volume or sophistication of tax strategy) |

(Note: Actual prices vary by firm; these ranges reflect typical UAE market benchmarks.)

What triggers extra fees for VAT Filing & Other Processes?

Most VAT firms charge extra when the work moves beyond routine filings. Common triggers include:

- Missing or incomplete documentation (requiring manual reconstruction or ledger cleaning)

- High-volume transactions, especially e-commerce or logistics operations

- Refund claims, due to additional evidence reconciliation

- Complex free-zone or designated-zone movements

- Audit representation beyond standard support levels

- Historical corrections for previous VAT periods

- Cross-border structuring or multi-emirate supply chain reviews

To stay cost-effective, choose a consultant that provides flat-fee clarity, flags out-of-scope items early, and automates high-volume recurring tasks in order to reduce manual labor costs.

Getting Started with Skrooge VAT Consultants

Why are we the right consultants in Dubai for you?

Think of us as your modern finance partner built on two strengths: experienced professionals who understand UAE tax law inside out, and Skrooge, our intelligent AI CFO. This allows us to deliver precise, thoughtful guidance while our automation capability takes care of the repetitive and menial tasks. Through our combined approach, we are able to provide more effective advice, reduce any avoidable mistakes, and make your day-to-day easier for you to manage. Our goal is straightforward: we hope to give you clarity, save you time, and keep your finances compliant without adding unnecessary bandwidth.

How we streamline your VAT setup and compliance

We know VAT can feel confusing at the start. Monitoring taxable sales, assembling documents, filling out government forms, and keeping track of deadlines—all while trying to run a company—quickly becomes overwhelming.

With skrooge.ai, that burden shifts off your plate. We organize your documents, keep an eye on compliance rules, and guide you through every step under VAT regulations. Once you’re registered, we continue to handle your VAT obligations as part of your ongoing accounting.

Here’s what that looks like in practice:

- Smooth registrations from end-to-end. We prepare, review, and submit everything so your application goes through smoothly and approved on our first try.

- Consider your threshold monitoring handled. We consistently track your rolling 12-month turnover and alert you in advance when VAT registration becomes mandatory.

- Deadlines on autopilot. Automated reminders and structured workflows keep all filings on time.

- Future-proof compliance. We maintain your books, keep your documents organized, file VAT returns and overall ensure tax compliance so your filings remain accurate and audit-ready every period.

If you want to explore this, we can walk you through it by simply booking a short call. From there, our team will reach out with more information, answer your questions and/or concerns, and through our 15-minute VAT consultation process, simply share with us your tax records and a sample of invoices to get a clear view of next steps. Once all is in order and confirmed, onboarding will be done with professional accountants who will conduct further diagnosis of your business.

This material is for informational purposes only and does not constitute legal or tax advice.

Frequently Asked Questions (FAQs)

As soon as you hit the mandatory threshold set for registration of AED 375,000 for the last 12 months, you must immediately file for registration within 30 days to avoid penalties.

Expert VAT consultancy fees in the UAE varies depending on the scope of work, the firm’s expertise, and whether the engagement includes ongoing support or one-off tasks.

While some comprehensive VAT consultancy services may charge hourly, they usually bundle services into monthly pricing that can range from AED 499 monthly to AED 6,000 depending on the level of sophistication your business needs. Most recuperate the costs of hiring services in Dubai by achieving a level of tax efficiency, usually offset by the refund from VAT return filing.

According to the FTA, registered businesses must file their VAT return and pay any tax due within 28 days from the end of the tax period. For most businesses, the tax period is quarterly (every three months). Some larger businesses (e.g., those with high annual taxable supplies) may be required to file monthly.

An FTA VAT audit reviews your records to verify tax accuracy. You’ll receive a notice, submit invoices and ledgers, and possibly undergo an on-site inspection. The FTA checks output tax, input claims, and reconciliations, then issues findings. If errors exist, you may face adjustments or penalties.

Yes. You can file your tax refund in the UAE if you’re in a net refundable position. You must apply through the FTA portal and submit the VAT return form as well as proof (i.e. invoices and bank validation documents)

Common VAT penalties under UAE tax regulations include:

• Late mandatory registration (i.e. after 30 days have lapsed upon hitting the threshold) – AED 10,000

• Late return filing – AED 1,000 then AED 2,000

• Late payment – 2% immediately + 4% a month after due date until 13 April 2026. Effective 14 April 2026, penalties will be flat 14% per annum, calculated monthly on unpaid tax

• Failure to issue a VAT-registered invoice – AED 2,500 per missing invoice

• Noncompliance- Failing to keep accounting records as required can result in a fine between AED 50,000 and AED 500,000. Additionally, not keeping the records for the required five-year period can lead to an additional fine between AED 20,000 and AED 100,000.

The AED 375,000 threshold is the amount of taxable turnover at which VAT registration becomes mandatory for UAE businesses. This includes standard-rated, zero-rated, and reverse-charged taxable supplies, as well as imports.

What this means is that when checking if you have reached the VAT registration limit, you don’t only count sales where you charge 5% VAT. You also have to include sales that are taxed at 0%, plus any goods or services you bring in from outside the UAE, even if you didn’t actually pay VAT at the border. General rule of thumb is if money comes in from business activity that is normally taxable under UAE VAT rules, it should be counted.

Once this threshold is exceeded within a rolling 12-month period, or if a business reasonably expects to exceed it in the next 30 days, the business is legally required to register for VAT. Failure to do so may result in administrative penalties.

According to UAE VAT law, AED 375,000 mandatory threshold applies to VAT, not Corporate Tax. Corporate Tax has no registration threshold; you must register even with zero income.

Thank you!

We've received your request and will get back to you shortly.